The Fed's "War" With Investors

- Joe Carson

- Jan 30, 2023

- 3 min read

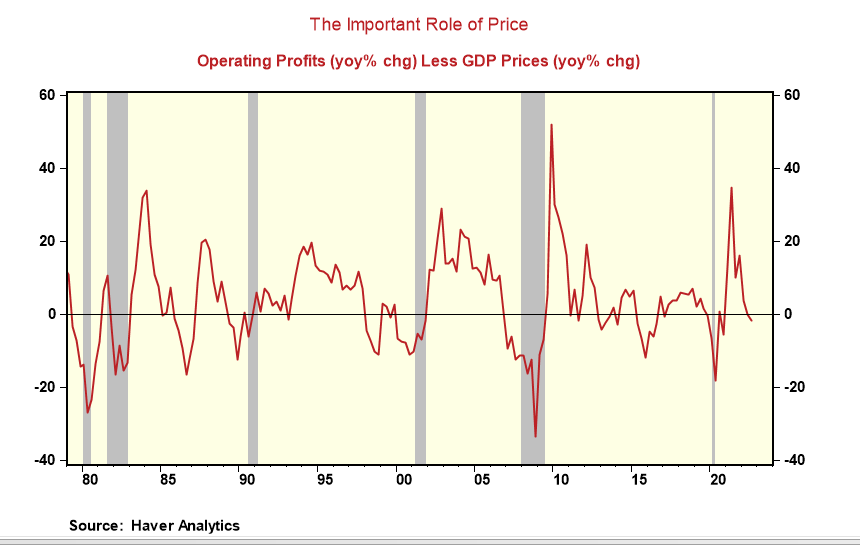

The Fed is at a "war" with bond and equity investors. It is not a "war" in the strict sense. But the Fed is on a mission to extract a large chunk of inflation from the economy and keep it out. In prior battles against inflation, financial markets aided the Fed's fight. Yet, bond and equity investors are operating with a different script nowadays, lowering borrowing costs and raising equity values (future spending power) which run the risk of extending the price cycle. As we have learned from past experiences, "wars" (even financial ones) are not painless. Investors may be on the right side of this "war," but even being on the right side doesn't eliminate investment risks. Equity investors are the most vulnerable, as operating profits adjusted for prices declined at the end of 2022. A more significant slide is ahead if the Fed is committed to hitting the inflation 2% target.

The Important Role of Price

In 2022, the nominal output (GDP) increased by 7.3%. And the price component accounted for 630 basis points of the 7.3% gain in nominal output, while the output gain was a mere 100 basis points.

What an economy produces is equivalent to what an economy earns. In other, nominal GDP (output and price) is equal to gross domestic income (workers' income and firms operating profits).

Price is a critical factor on both sides of the equation. It is direct input in the GDP calculation. It is also a factor on the income side, as it is a significant component of companies' aggregate profits after excluding total unit costs from revenues.

At What Price?

The Fed wants the price component to slow to 2%, or 400 basis points less than what occurred in 2022. (Note: the Fed's 2% inflation target is for consumer prices, but since the GDP and PCE deflator run parallel, the GDP deflator would also need to drop to 2% if the Fed hits its target).

The "war" between bond investors and Fed is unusual, not from the standpoint of the bond market front running Fed policy. It is only different this time because the Fed is targeting a 2% inflation rate. And a drop in borrowing costs (including mortgages and corporate credit) occurring long before reported inflation is close to 2% runs the risk of extending the price cycle.

Equity investors are also on a different page. It is mathematically impossible for aggregate inflation to decelerate by 400 basis points and for operating profits not to decline. In the past, even modest declines in aggregate inflation triggered declines in corporate earnings. How big of a fall will depend on how firms manage their costs, especially labor costs. The last two significant profit recessions saw 20% and 30% declines, and aggregate inflation declined half as much as the Fed wants to achieve this time.

Bond and equity investors have gone to "war" with the Fed. In those "wars," the markets won as they were correct to conclude Fed policy was too tight. But those victories still resulted in substantial losses for bond and equity investors as monetary policy triggered sharp economic slowdowns and recession, resulting in corporate defaults and massive losses in the equity markets.

The Endgame for Investors

One of the critical risks for the Fed is whether easier financial conditions are a roadblock to a sustained drop in inflation. That's yet to be determined, but it should compel policymakers to keep official rates high for an extended period.

As we have learned from past experiences, "wars" (even financial ones) are not painless. Investors may be on the right side of this "war," but even being on the right side doesn't eliminate investment risks. If inflation drops sharply, it will result in sharply lower corporate earnings as they are highly correlated. Operating profits adjusted for GDP prices were already declining at the end of 2022, and there is a longer slide ahead as the inflation rate drops to 2%. If inflation doesn't drop, the Fed will need to push official rates higher.

Comments