Goods News on Inflation Comes With a Cost---Shrinking Profit Margins

- Joe Carson

- Dec 13, 2022

- 1 min read

The slowdown in consumer price inflation is good news, but it does come with a cost; shrinking profit margins. In November, consumer prices rose 0.1% and 0.2%, excluding the volatile food and energy components. Combined, those were the lowest price increases since January 2021.

Before the last two months, consumer price increases have exceeded companies' unit costs, especially for labor. But now, that process is reversing, with labor costs rising faster than prices.

Average wages for non-supervisory workers increased by 0.5% in October and 0.7% in November. The cumulative wage increase of 1.2% over the past two months is over 2X the rise in headline consumer prices and prices excluding food and energy.

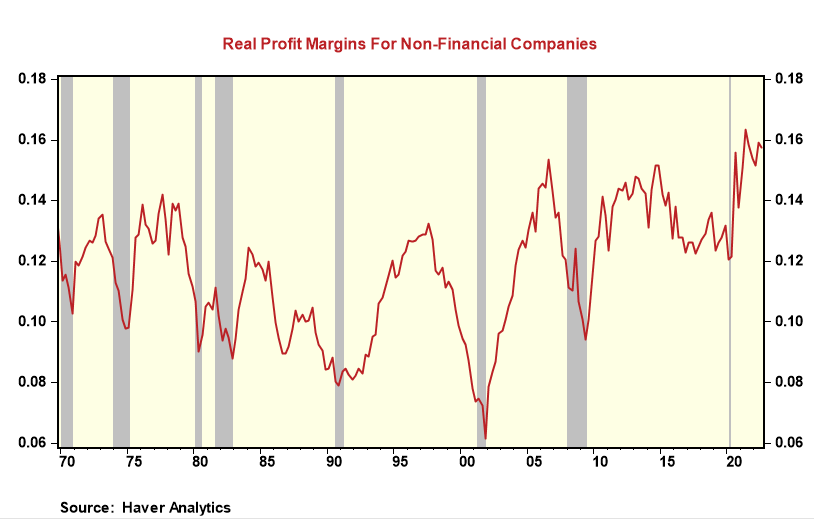

As mentioned in a previous report, this has been a "pain-free" tightening cycle for companies as real profit margins in 2022 have stayed exceptionally high, matching the levels of 2021, which were the highest in 60 years.

Yet, history shows that a Fed tightening to combat a cyclical rise in inflation cycles ends with sharply lower profit margins. Declines of 200 to 500 basis points in real profit margins occurred during the tightening cycles of 1980, the 1990s, and the 2000s.

Also, cyclical declines in real profit margins tend to be a multi-year affair. So investors need to balance the good news on lower inflation, a potential Fed pause with shrinking margins. Good hunting.

Comments