When Companies Talk, The Fed Should Listen

- Joe Carson

- Nov 1, 2021

- 2 min read

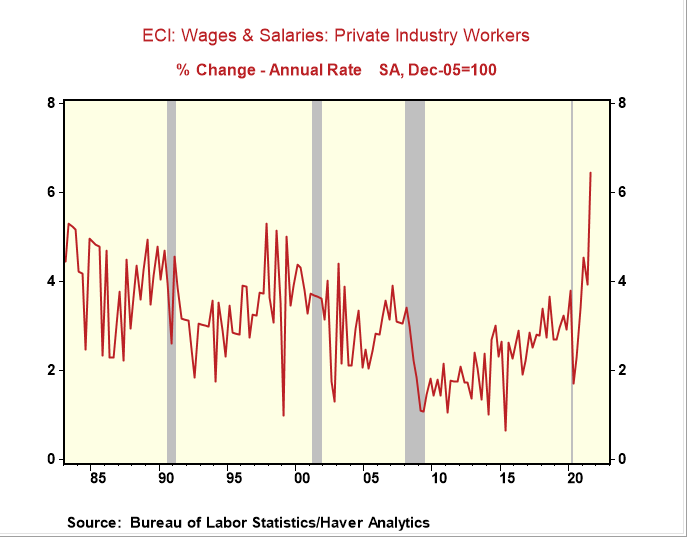

According to the Bureau of Labor Statistics, private industry wages and salaries increased 6.5% annualized in Q3. That's the fastest increase recorded in this wage series in nearly 30 years. The surge in labor costs should not be a surprise.

Big and small companies have been talking publically for many months about labor shortages and the need to raise wages to keep staff and attract new workers. The pressure on labor costs is widespread but is most severe in services, the segment of the private sector workforce that accounts for 84% of all jobs.

Walmart last month raised its hourly pay for nearly 500,00 workers. Amazon announced it was offering sign-up bonuses to recruit workers. Costco announced it was increasing its starting salary only a few months after raising the minimum wage earlier in the year. Starbucks announced pay increases starting in January and additional increases next summer to encourage workers to stay at the firm.

Even after boosting wages by the most significant amount in three decades, firms are telegraphing the need to do more to maintain and recruit staff. In other words, the labor shortage is not going away anytime soon.

That message has fallen on deaf ears at the Fed. At this week's Federal Open Market Committee, policymakers will announce the scaling back of its asset purchases. Yet, it still will maintain the current stance of zero official rates. Fed Chair Powell has seemingly separated the purpose of its two policy tools, namely, asset purchases and official rates. Powell has linked asset purchase to inflation and official rates to the labor market.

Powell is using the pre-pandemic jobless rate and employment levels as gauges to its full employment mandate. Yet, history shows that no two labor markets are alike. And, the precise moment when the sweet spot for the demand for labor and the supply of workers is met is not based on any arbitrary metric, but when a broad range of companies start increasing wages and offering even more to new workers in order to compete. At that point, it's the view of companies, not policymakers or economists, that the labor markets have passed the point of balance.

Companies have declared that the country is at full employment. The Fed should declare victory and start to normalize official rates at the same time as it plans to scale back its asset purchase program. However, the Fed is not listening, and the continuation of the easy money will only add to labor market pressures and more inflation.

Comments