We Were All Wrong: The Starting Point Was Zero

- Joe Carson

- Nov 3, 2022

- 2 min read

When policymakers started to raise official rates in the spring, the official projections showed an official peak rate of 2.8% at the end of 2023. With inflation running much faster at the time, I argued that the peak rate could be as much as 100 basis points higher than what the Fed was telegraphing. We were all wrong.

Four consecutive seventy-five basis points increases and three hundred and seventy-five basis points in eight months look like a substantial increase in official rates. But the starting point was zero, and much more is still needed to reverse inflation risks.

Price increases lead to revenue and profit increases for companies, while wage increases trigger income gains for workers. So when the price cycle broadens and wages increase, it takes more and more rate hikes to break the cycle because higher profits and income offsets the higher borrowing costs.

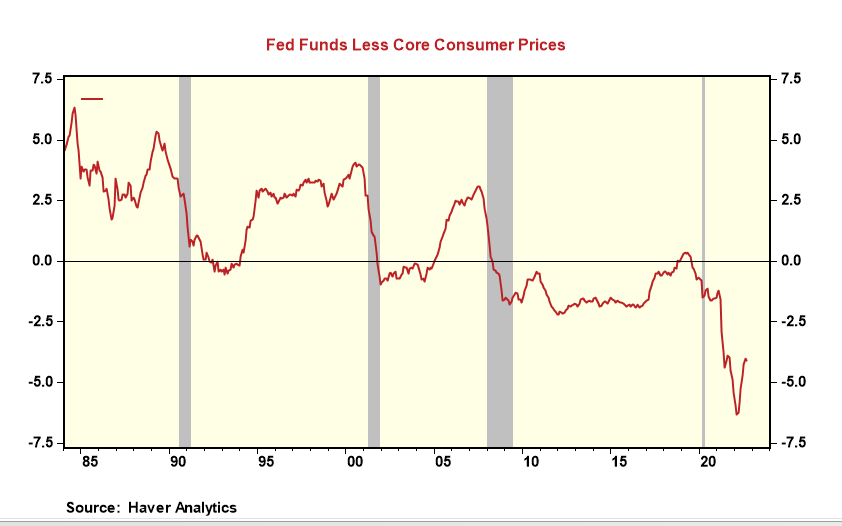

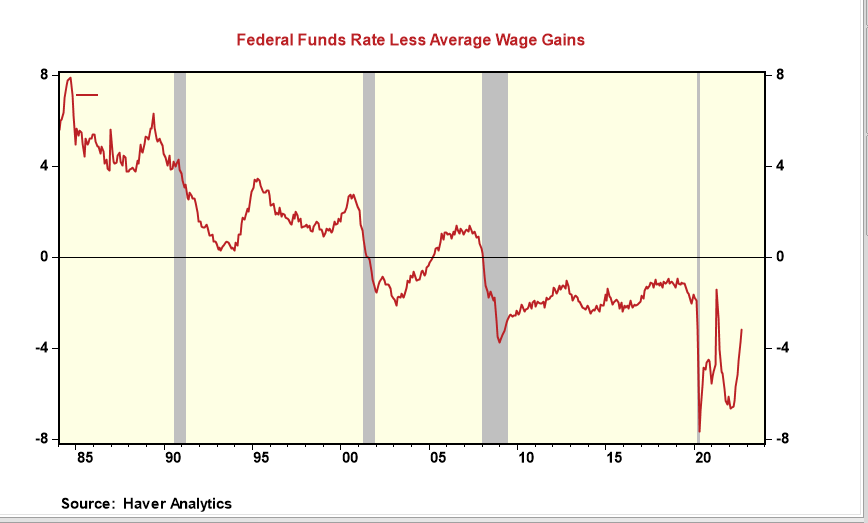

In October, core consumer prices were up 6.7% from one year ago, while average wages for non-supervisory workers increased by 5.9%. Price increases are 260 basis points above last year's gain, while wage increases are roughly the same. At 4%, the fed funds rate is still far below the price and wage gains, so there is more ground to cover before the policy is even neutral, let alone restrictive.

Businesses and consumers do not borrow at the fed funds rate. But the federal funds rate is the benchmark for all borrowing costs, so for market rates to be at levels that restrict borrowing, the Fed needs to lift rates to prohibitive levels. The fed funds moved above price and wage gains in the past three cyclical inflation cycles (the 1980s, 1990s, and 2000s).

So we all were wrong. Fast and broad price and wage gains require higher official rates.

Comments