Unprecedented Fiscal & Monetary Stimulus Drives Record Wealth Gains---Yet, Are They Sustainable?

- Joe Carson

- Oct 19, 2023

- 2 min read

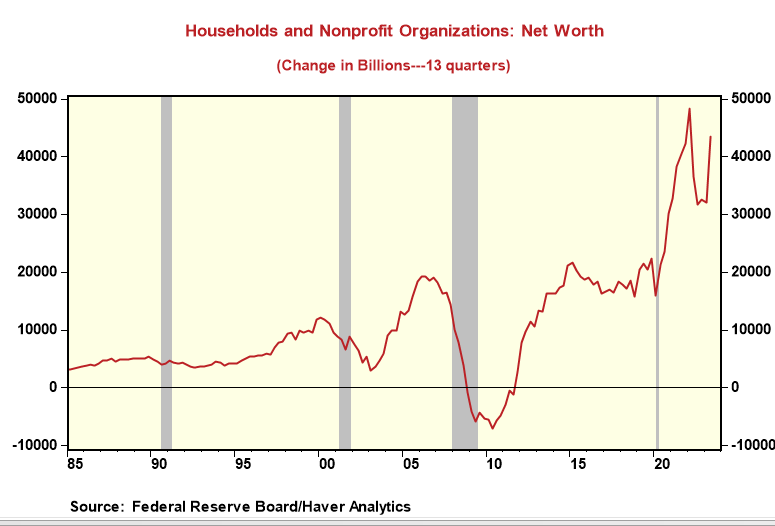

Household net worth has increased by $43. 4 trillion since the start of 2020. With household net worth at $154 trillion, roughly 30% of that was created in the past three years. Never before has the US created so much wealth in a short period, and what makes the increase even more difficult to believe is that it occurred during the worst healthcare crisis in 100 years and the sharpest plunge in economic activity on record.

How did it occur, and is it sustainable? There were three tranches of fiscal stimulus amounting to roughly $5 trillion and approximately $5 trillion of quantitative purchases by the Federal Reserve. So, the record "paper" wealth gains were a direct cause of the most concentrated and aggregate fiscal and monetary stimulus ever seen.

If record stimulus triggered the gains, it makes sense that "paper" wealth gains' sustainability requires monetary and fiscal stimulus to stay in the economic and financial system. Yet, with the Fed reversing QE and raising official rates, record financial asset prices are not sustainable, and in time, nor will real asset prices be as well. So, a payback is coming, and if Congress passes significant tax increases in the future to reverse record fiscal deficits and stimulus, more pressure would occur on asset prices and trigger more wealth losses.

How much wealth losses can the US incur without triggering a recession? That's a hard call. Nobel Prize-winning psychologist Daniel Kahneman wrote, "For most people, the fear of losing $100 is more intense than the hope of gaining $150." So, even if households lost 10% to 20% of the recent gains, which would still leave them with significant wealth, it would trigger a substantial pullback in consumer sentiment and spending.

Comments