Uh-Oh! Credit Boom Accelerates---How Does The Fed Stop An Inflation Cycle With Easy Credit?

- Joe Carson

- Oct 20, 2022

- 1 min read

Updated: Nov 14, 2022

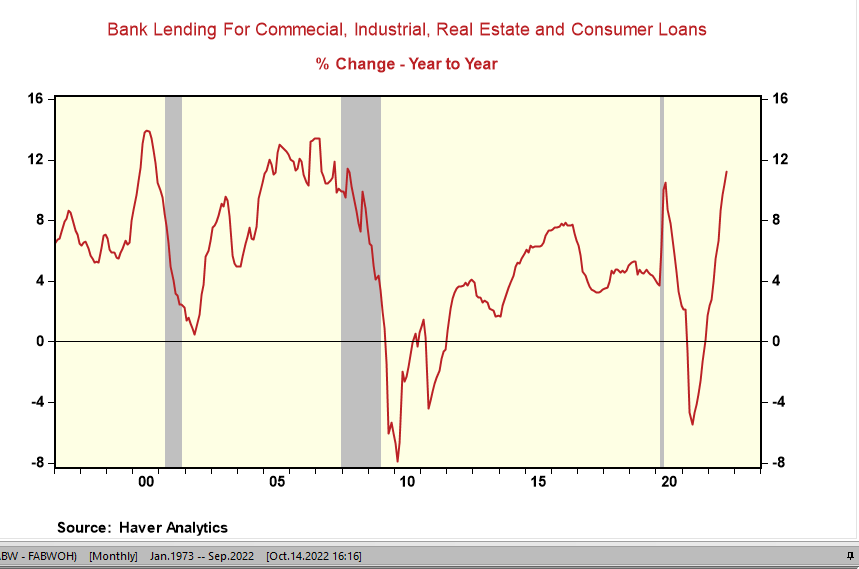

Uh-Oh!. The credit boom gets stronger; bank lending for commercial, industrial, real estate, and consumer loans increased by 11.7% in the last twelve months ending in October. That's 50 basis points faster than the previous reading. C&I and real estate lending accounted for the acceleration. In the past year, C&L loans are running at +15.2%, consumer loans (including credit cards) at +12.6%, and real estate at 9.6%. How does the Fed stop an inflation cycle with easy credit? It doesn't.

Comments