The Happy Prophecy That The Tightening Cycle Is Over Is Based On Hope, Not Hard Evidence

- Joe Carson

- May 11, 2023

- 2 min read

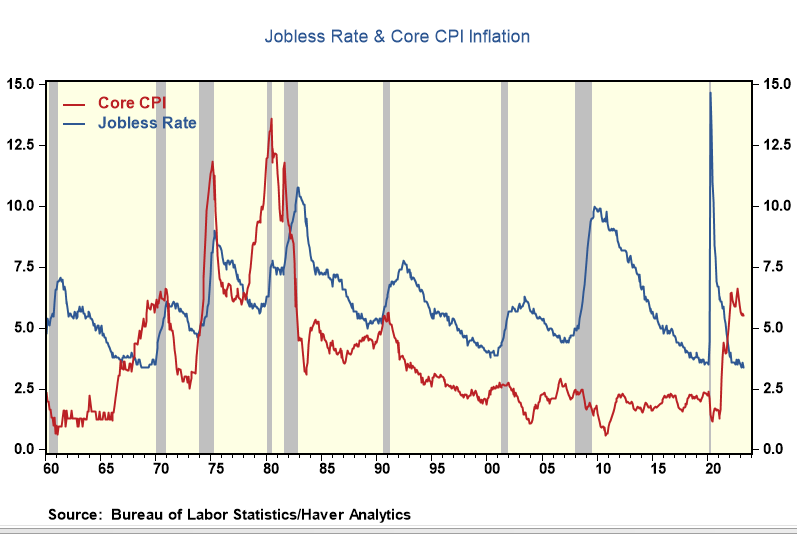

The current combination of today's low jobless rate (3.4%) and a high core inflation rate (5.5%) occurred only once in the post-war period, which was in the late 1960s. The Fed eventually broke that inflation cycle, doubling the unemployment rate in almost a year and pushing the economy into recession. Still, it required lifting official rates to 9%, approximately 400 basis points above today's rate and well above the trailing inflation rate.

The financial markets think, "This time is different." Investors believe the Fed can end the inflation cycle without additional tightening. But two factors argue against a benign outcome anytime soon.

First, the labor market is exceptionally tight, and a strong wage cycle is underway. The current number of job openings at 9.56 million is 1.6 times the number of people unemployed. Based on the current labor market force, the economy would need to lose nearly 2 million jobs to trigger a one percentage point rise in the jobless rate. That's not likely as long as there's a supply shortage of available workers for job openings. As a result, the most robust wage cycle for non-supervisory workers (80% of the workforce) in almost 50 years should continue to run fast and fuel increases in spending.

Second, the Fed's quantitative easing tool makes it more difficult for official rate hikes to flow through the entire yield curve. The Fed has raised official rates by 225 basis points since September 2022, and the yields on 10-year Treasuries are lower by about 20 basis points and roughly 170 basis points below the target on the Fed funds rate. Are low long-term rates a function of well-anchored inflation expectations or more related to the scale of QE? I argue the latter as the scale of QE is twice the level of three years ago. Also, the idea of tightening to break the inflation cycle is to make borrowing expensive. People don't borrow at the fed funds rate but at spread over longer-term yields.

Is it possible to trigger a sustained slowdown in borrowing and spending with low market long-term rates? History says that low market borrowing costs offer greater odds of an economic re-acceleration than a sustained slowdown in inflation. In the late 1960s, long-term rates moved higher in unison with the hike in official rates and stood above the Fed target rate. The combination of high official and market rates broke the growth and inflation cycle. The happy prophecy that time is different is based more on hope than hard persuasive evidence.

Comments