The Fed's GDP Price & Spending Bubble

- Joe Carson

- Apr 28, 2022

- 1 min read

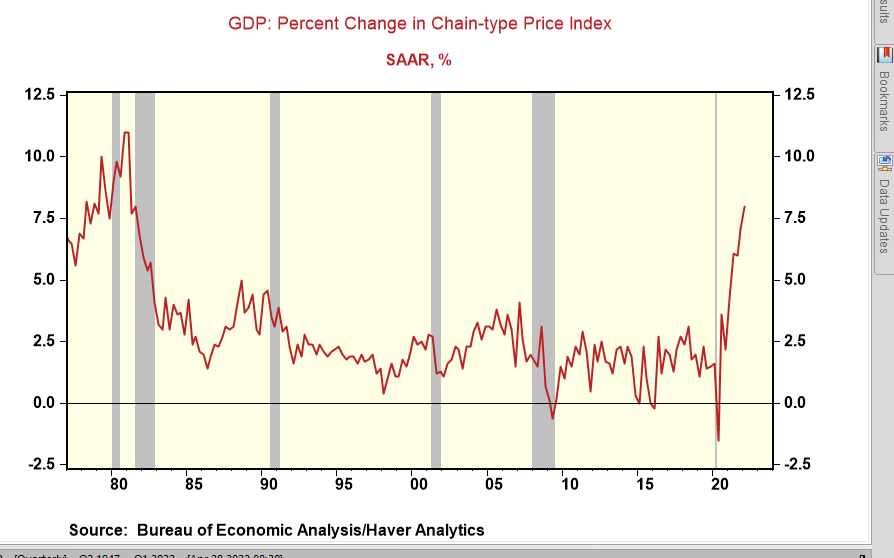

Q1 GDP showed how big the Fed's inflation and spending bubble has become. The GDP price deflator rose at an annualized rate of 8% in Q1, the fastest quarterly increase since 1981. It also represented the fourth consecutive quarterly gain in GDP prices at 6% annualized or above. The last time that occurred was during the high inflation years of 1980 and 1981.

Monetary policy influences nominal spending, not real or inflation-adjusted. The 1.4% annualized decline in Q1 real GDP is not a sign of weak spending by consumers and businesses. Consumer spending and non-residential investment spending, the primary drivers of private sector demand, increased at 11.5% in Q1. That represents one of the fastest quarterly gains on record and is far too fast to slow the inflation pulse in the economy.

Policymakers are still hoping to lift policy rates " expeditiously " and pull off a soft landing in the economy as they did in 1995, following the boom of 1994. The problem is that nominal spending is not moving at the same speed as in 1994. Consumer and business spending is nowadays is running roughly twice fast as it did in 1994, suggesting that even if policymakers adopted the same rate strategy of 1994, it might not be sufficient.

The odds of halving the growth in nominal spending without triggering a recession are low, even with a preemptive policy. It is getting closer to zero as long as the Fed fails to launch an aggressive policy response.

Comments