The Fed's Dot Game: "Something Missing"

- Joe Carson

- Mar 18, 2021

- 2 min read

The Federal Reserve members' updated projections at the March 16-17 Federal Open Market Committee (FOMC) paint an optimistic economic view and an unrealistic monetary policy picture. Policymakers now agree with private forecasters that the US economy will experience in 2021 its faster growth rate (+6.5%) since the early 1980s. And relatively strong growth will continue for an additional two years, enabling policymakers to hit their mandate of full employment by 2022 (3.9% jobless rate) and price stability (2%) as well. Yet, policymakers plan to keep official rates near zero into 2024.

How realistic is that? It's not. Policymakers will soon have a credibility problem, if not already, as the economy and markets force a policy adjustment long before 2024.

The Dot Game!

The Federal Reserve started to provide economic and policy projections in 2012. The projections summary comprises the members' estimates of growth, unemployment, and inflation, and it also shows a "dot" plot of each member's view of official policy rates. The summary is not an official Fed economic forecast, nor is it intended to be used as a script to alert the market for the timing of potential changes in policy rates.But the financial markets view it as one.

At the press conference following the Federal Open Market Committee meeting of March 16-17, Federal Reserve Chair Jerome Powell stated that actual economic outcomes would dictate policy decisions and not forecasts.

Nonetheless, it would be interesting to see how Mr. Powell would have responded to a reporter asking, "If the economic projections are close to the actual outcomes, is it realistic to think that policy rates remain at zero until 2024"?

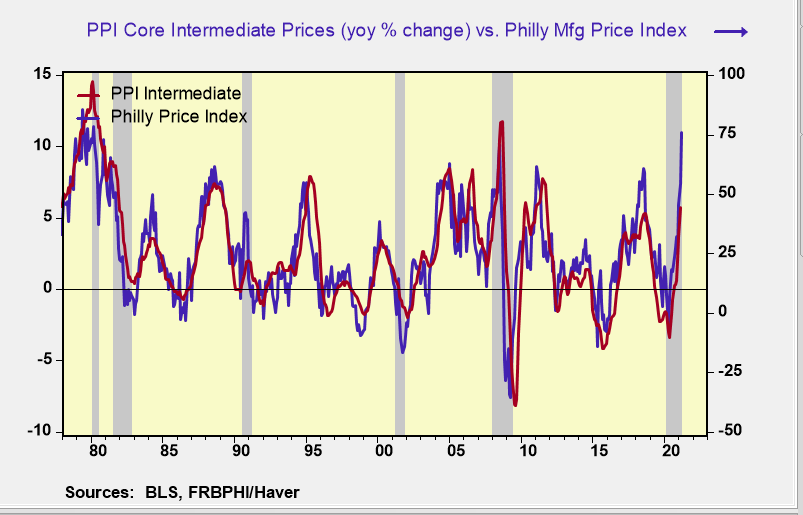

How long the Fed can continue to push this dovish policy view is difficult to pinpoint, but economic conditions are quickly changing for the better. The Federal Reserve Bank of Philadephia composite index of manufacturing jumped nearly 30 percentage points to 52% in March, the highest reading since 1973. The price index, which has a remarkably high correlation with the producer prices core intermediate price index, jumped 20 points to 75%, highest reading since 1979.

Recovery in the manufacturing sector is always a harbinger of faster economic growth. But pent-up demand in the current cycle is centered more so in the service sector. So if the manufacturing industry is expanding at a rapid rate at the same time, the odds of solid growth performance and rise in inflation increases doubly so.

A dovish monetary policy was necessary to help cushion the economy from the fallout from the pandemic. A dovish rate stance is the wrong policy approach when the economy runs full speed as it will foster imbalances that threaten economic stability. The jump in long-bond yields following the FOMC meeting indicates financial market participants believe there is "something missing" in the "dot" plot on policy rates.

A dovish policy stance (i.e., zero rates for the next three years) is not a friendly finance policy when inflation pressures are building. Expect long-bond yields to rise to 2% soon, and then 3% by year-end.

Comments