Taking Away The "Punch Bowl": Risk Of Hard Landing In Consumer Spending

- Joe Carson

- Aug 20, 2020

- 2 min read

With each passing day, the failure of Congress and the Administration to reach a deal on extending fiscal stimulus creates a bigger and bigger hole in consumer cash flow. So far investors have brushed off the stalemate. But that’s a mistake.

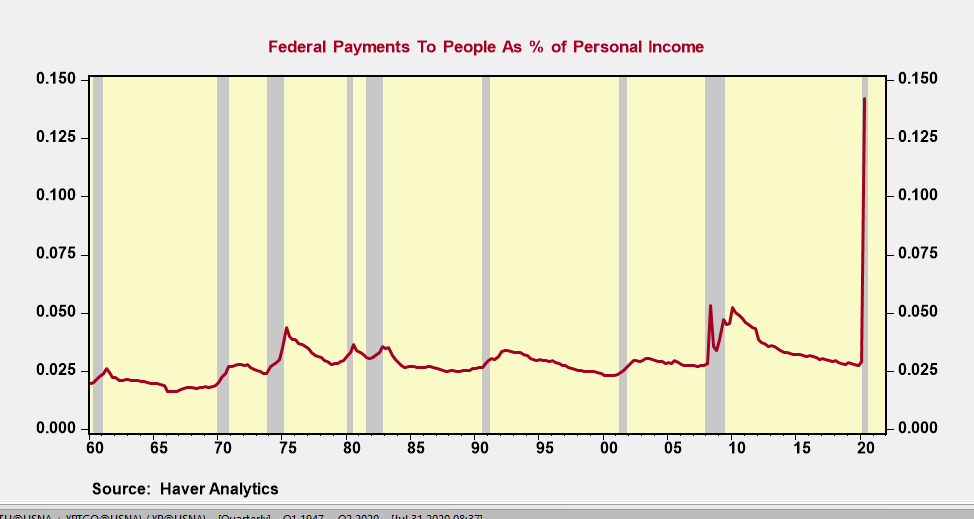

That's because the federal stimulus payments that flowed to people in Q2 was the largest on record. Removing the “punch bowl” of stimulus entirely or even in half raises the risk of a hard landing in consumer spending.

Boom To Bust

According to the Bureau of Economic Analysis (BEA), special federal payments to individuals and small businesses (proprietors) in Q2 boosted personal income by $ 3.2 trillion annualized. That figure includes direct stimulus payments, an increase in unemployment compensation to a broader group of workers, and forgivable loans to small businesses (proprietors) that are included in the personal income data.

The actual boost to consumer cash flow was even larger because millions of renters and homeowners were allowed to forgo monthly rent and mortgage payments.

So how big is $3 trillion in federal payments to people? It’s humongous.

Here are two examples.

First, the federal payments of $3.2 trillion to people and small businesses equaled nearly 15% of personal income. To put that in perspective, personal tax payments in 2019 totaled $2.2 trillion, or 12% of personal income.

So the scale of stimulus payments Congress sent to people in Q2 was $1 trillion more than what people pay in taxes for an entire year. Never before has any federal tax cut or special payment to people has ever come close to something of that scale.

Second, Q2 wage and salary income totaled $8.85 trillion, off $680 billion from Q1 level. That means the infusion of $3.2 trillion in payments to people was nearly 5X times the amount of lost income due to job loss, fewer hours worked, and wage cuts.

In other words, Congress appropriated more spendable income to people than what was lost from the record 20 million-plus employment losses emanating from the closure of the economy.

The punch bowl reference is often related to monetary policy. Fed chairman William McChesney Martin once argued that the central bank's role is to take away the punch bowl just when the party's going well. What Mr. Martin meant was that if policymakers applied the monetary brakes sufficiently in scale and in time policymakers would have avoided excesses and imbalances from developing and therefore reduce the need for more forceful action that could send the economy off the cliff.

The punch bowl nowadays is centered on fiscal policy. Congress provided record payments to people in Q2 and cutting that off completely or even in half before labor markets are fully healed runs the risks of pushing the consumer and the economy off the cliff.

Just do the math. In Q2, fiscal payments to people equaled nearly $35 billion a day, or roughly $250 billion a week. With jobless claims at 1.1 million for the week ending August 15, it will not take long before the lack of federal support shows up in all areas of consumer spending.

Comments