Stimulative Power of Fed's New Tools Still Outweighs Drag From Old Ones:Economy's Growth Baffles Fed

- Joe Carson

- Oct 9, 2023

- 2 min read

Updated: Oct 10, 2023

Policymakers are learning in "real-time" the staying stimulative power of the Fed's quantitative securities purchases (QSP) and the scale of official interest rates required to neutralize its effects. How else can anyone explain 800,000 new jobs (60,000 in the interest-sensitive construction industry) created over the July-to-September period and estimated GDP growth of nearly 5% for Q3 after over 500 basis points in official rate hikes in the past 18 months?

Former Fed Chair Ben Bernanke, the mastermind behind this new policy tool, argues that QSP helps to lower long-term yields, and the effects are long-lasting. How long? No one knows, but one way to track the QSP effect is by looking at the spread between long-term yields and Fed funds.

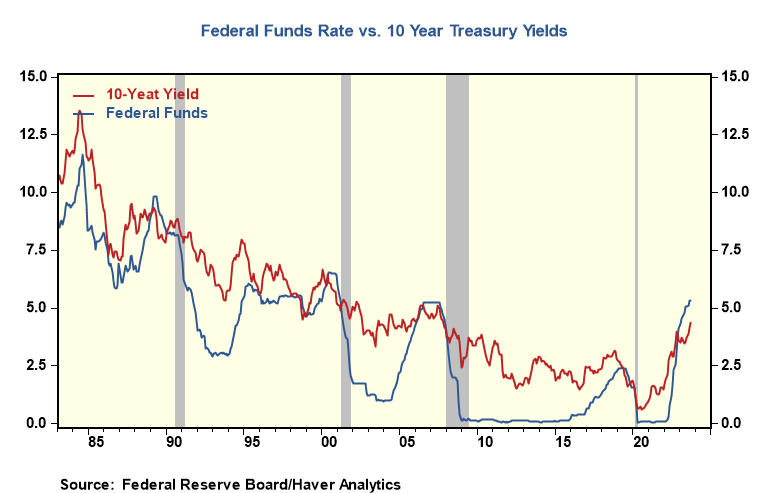

The Fed has been raising the Fed funds rates since March 2022. For half of those 18 months, the yield of the 10-year Treasury has run well below the Fed funds rate and still is well below. During every Fed tightening cycle of the past 35 years, the 10-year Treasury yield ran equal to or slightly above the Fed funds rate, especially when the economy was strong, and the Fed still was leaning towards more rate hikes.

Most of the focus of QSP is its direct impact on the Treasury yields. However, it also involves direct cash transfer (liquidity) into the financial markets and the economy as the Fed buys securities from investors. The Fed added $5 trillion to QSP over two years, which boosted asset prices and directly and indirectly consumer investment and spending behavior.

Mr. Bernanke also argues that for QSP to be effective, the economy's nominal "neutral interest rate" (observed after the fact) must be between 2% and 3%. Suppose the "neutral interest rate" is twice that, or 5% to 6%, close to the current target on fed funds, and is rising as is the case nowadays.

Does the stimulative power of QSP increase as the economy's nominal "neutral interest rate" increases, especially when the scale of QSP is still enormous?

Mr. Bernanke never contemplated this scenario or how to exit QSP when policymakers needed to shift the stance of monetary policy to the restrictive side.

We are in uncharted territory because never before has there been a period of a rise in the economy's nominal "neutral interest rate" and enormous QSP. At the end of September 2023, the Fed's security holdings stood at $7.44 trillion, roughly $1 trillion below its peak, but still stood nearly $ 4 trillion above the level when the Fed started its latest QSP program in 2020.

Does the stimulative power of $4 trillion of QSP outweigh the adverse effects of an estimated $100 billion increase in household net interest costs? The economy's growth performance says it does, but financial conditions models say the opposite. Why? Financial conditions models omit QSP.

P.

Comments