Shrinking Profit Margins Portend Bad News For Company Profits

- Joe Carson

- Jun 26, 2023

- 1 min read

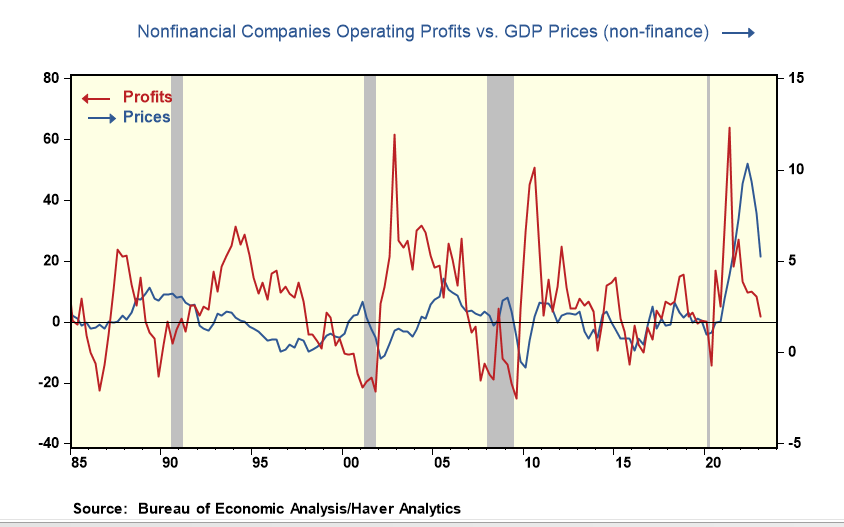

Nonfinancial companies' profit margins are starting to buckle as price increases no longer cover the rise in total unit costs, reversing a clear trend of the past two years in which rapid price increases far outpaced labor and non-labor unit cost increases.

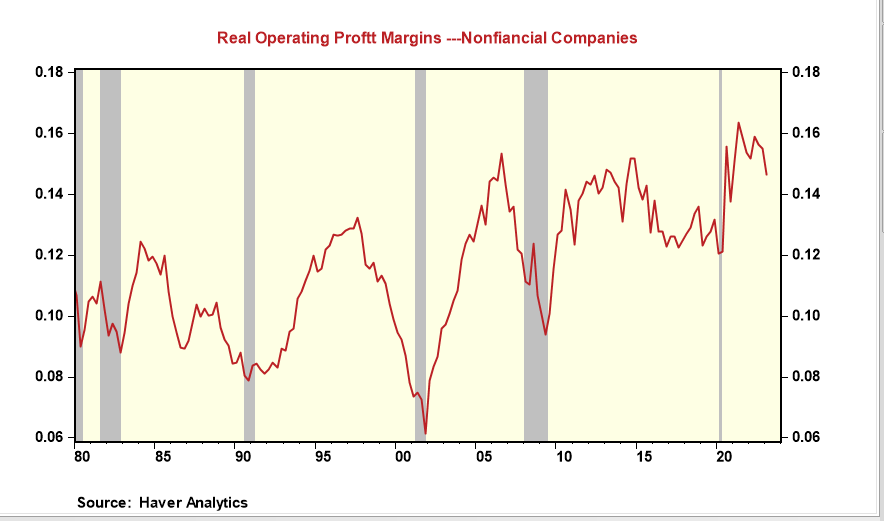

In Q1, real profit margins stood at 14.6%, down from 15.6% in the prior quarter and the lowest since Q4 2020. The margin squeeze stemmed from unit labor cost increases of 6% and non-labor cost increases of 5.5%, outpacing the 5.3% price gain.

Nonfinancial companies' profit margins in 2021 and 2022 were the highest since the mid-1960s, as the cumulative increase in price outpaced labor costs by unprecedented 550 basis points. That script is reversing quickly.

In addition to the slower volume growth, the prospect of smaller price increases comes with revenue and earnings hit to companies, with the risk it could be significant if a corresponding drop in labor and non-labor costs does not accompany them.

Based on the GDP data, nonfinancial companies operating profits were up 2% in Q1 versus the comparable period one year ago. Yet, that gain still has sizeable price and volume gain increases. History shows that the reversal in profit margins runs for several quarters, so it should not be a surprise if operating margins shrink to pre-pandemic levels over the next several quarters, off 200 to 300 basis points from the Q1 level, triggering a double-digit decline in nominal profits.

Comments