Remnants of QE Is Supporting Bank Lending

- Joe Carson

- Feb 6, 2023

- 2 min read

Bank lending is the principal channel to capture the effects of a tighter monetary policy. Yet, bank lending to businesses, real estate, and consumers accelerated throughout 2022, the fastest annual growth since 2006, even as the Federal Reserve raised official rates by 425/450 basis points. How can bank lending stay so strong against a backdrop of higher official rates, interest rates that the financial markets think are prohibitive, as the market yield curve (or the spread between 10-year Treasuries and the three--month Treasury bill) is the most negative in decades. The answer is quantitative easing.

How Does Tight Money Impact Bank Lending?

When the Fed raises official rates, it reduces the volume of bank reserves in the system. Gradually, a reduced volume of bank reserves occurs relative to the demand----that's how tighter credit conditions evolved.

Every tightening cycle associated with an inverted market yield curve has triggered a sharp drop in bank lending in the past forty years. Yet, none of the prior tightening cycles had to overcome a massive quantitative easing cycle, leaving the banking system with abundant reserves.

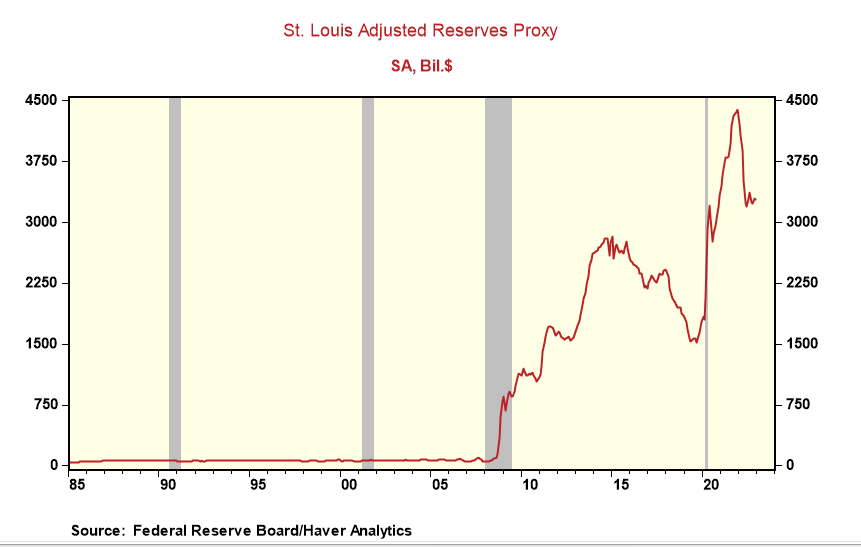

The Federal Reserve Bank of St. Louis estimates bank reserves. According to their estimates, bank reserves stood at $3.3 trillion at the end of 2022, $1 trillion below the peak of 2021, but still double the level of bank reserves in place before the pandemic.

The remnants of quantitative easing cycles have sustained the flow of bank credit, which should continue to be the case given the massive volume of reserves in the system. As a result, market rates may have to go much higher to blunt the positive effects of prior quantitative easings, slow credit growth, and bring about the sustained deceleration of inflation. That's not something that the Fed or the financial markets are thinking about nowadays, but it is a growing risk.

It is not something the markets or Fed policymakers are considering now.

Comments