Rebound In Cyclically-Sensitive Sectors Shifts Recession Risks to "Shaky" Finance (Again)

- Joe Carson

- Apr 27, 2023

- 2 min read

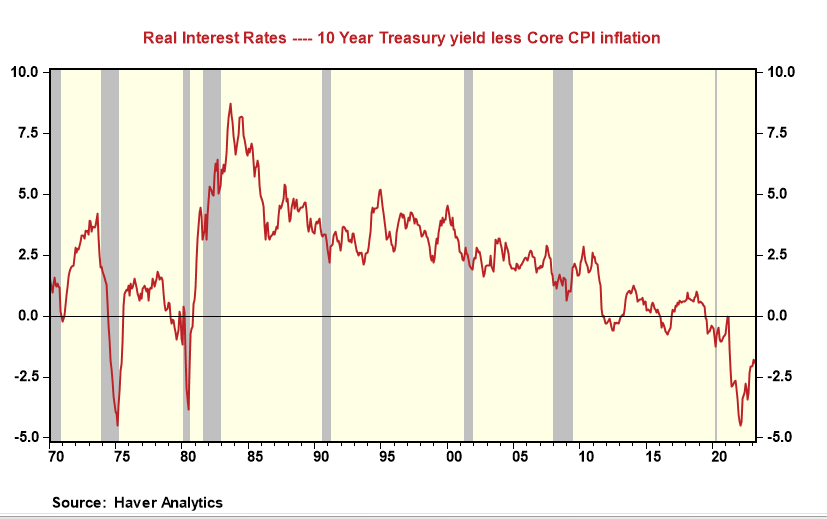

So far, the US economy has defied the recession forecasts. Real GDP grew slightly in Q1, increasing 1..1% annualized, following a more robust 2.6% gain in the prior quarter. The slight rebound in the cyclically-sensitive motor vehicle and housing sectors and negative long-term real rates suggest a traditional economic recession is not a risk for now.

In Q1, motor vehicle output and residential investment expanded by 1.3% annualized. That represents the first quarterly gain since late 2021 in these two sectors. Moreover, negative long-term real rates should support these sectors in the coming quarters. Also, a traditional cyclically-sensitive sector-driven recession had never happened when real long-term rates were negative as they are nowadays.

Yet, recession risks are not zero. If a recession occurs in 2023, it will come from "shaky' finance. Many banks on sitting on huge losses in their asset portfolio as they did not hedge for a rise in interest rates. Bank losses could reduce their lending ability, creating a supply-driven credit crunch. That is not evident today, but the risks are real.

"Shaky" finance triggered the last two recessions. In 2001, capital flows to tech companies (many without profits) dried up following the collapse of nose-bleeding tech equity prices, triggering a mild economic contraction. In the 2007-09 period, the US experienced the most prolonged and most severe downturn in the post-war period as "shaky' finance in housing triggered massive losses in the banking sector and capital markets, financial bankruptcies, credit crunch, and near-record high joblessness.

Growth in cyclically-sensitive sectors and "shaky" finance puts the Fed in a pickle. Do they tighten to avoid a rebound in economic growth and possibly more cyclical inflation or pause at some point to prevent "shaky" finance from triggering an economic recession? If the Fed remains true to its inflation promise, it will tighten.

Comments