Reality Check: Bull Case For Q2 S&P 500 Profits Is $0

- Joe Carson

- Jun 28, 2020

- 2 min read

Equity investors have focused on the potential earnings companies will report once the pandemic ends. But optimism about future profit growth will have to be scaled back once investors see the operating profit numbers for Q2. In my view, the base case for Q2 S&P 500 operating profits is a loss of a few dollars a share and the bull case is $0. Under either scenario, the stock market current valuation is the most expensive on record.

S&P Profits

In Q1, S&P 500 operating profits were reported at $19.50 a share, off 50%, or $19.7 from Q4 2019 levels. The dollar drop was the largest in the past 30 years, well above the prior record drop of $15.30 a share in Q4 2008 that occurred during the Great Financial Recession.

A dollar drop in operating profits equal to that of Q1 would be a bullish outcome since the decline in Q2 Nominal GDP could be 10X times the 1% decline in GDP in Q1, based on the recent GDP-Now report from the Federal Reserve Bank of Atlanta.

Also, S&P 500 companies get over 40% of their earnings from overseas operations. The pandemic slowed or stopped commerce in many parts of the world in Q2, especially the large economies in Europe where S&P companies have the bulk of their foreign operations.

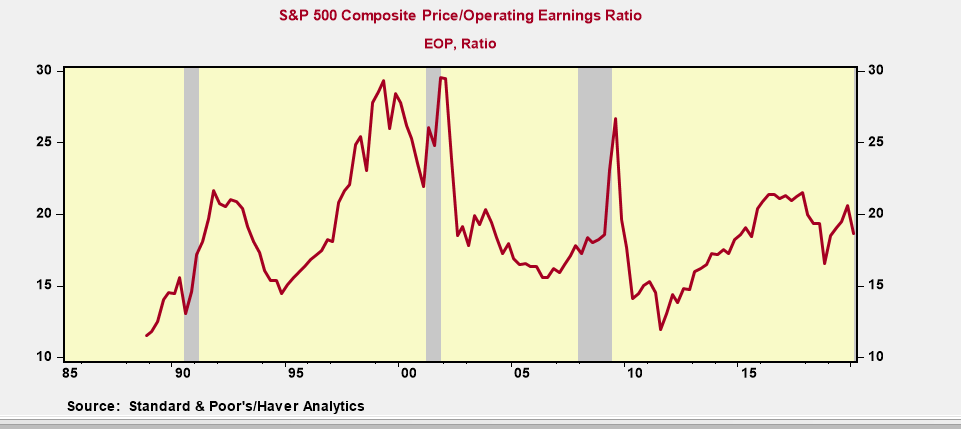

Assuming Q2 S&P 500 operating profits are zero aggregate profits for the trailing 12 months would be $98.5 a share. That would put the trailing 12-month P/E ratio around 30, based on the close of 3009 for the S&P 500 on June 26. The S&P 500 has never had a trailing P/E of 30. The record quarterly high P/E ratio for the S&P 500 is 29.3 in Q2 1999.

Critics may argue that companies have been given a “Hall Pass” for their poor operating performance in Q1 and Q2 due to the unprecedented and uncertain events emanating from the pandemic. Yet, even if you fell for that line of reasoning for the market to maintain a record P/E ratio of 30 for the next two-quarters S&P 500 companies would have to earn nearly $40 a share in Q3 and Q4. That would match what S&P 500 companies earned in the second half of 2019.

But the odds of companies matching 2019 earnings performance is very low if not zero. Businesses are still operating well below normal, many major metropolitan areas have not allowed firms to open fully and now some are re-imposing prior restrictions or guidelines as COVID cases hit record numbers in the last week. Also, international commerce and travel have been hit hard as the pandemic has caused sharp declines in demand.

Nearly half of S&P 500 companies withdrew their earnings for Q2. So the variance in analyst’s estimates is unusually wide and confidence in estimates is low. The market was able to overlook a string of negative earnings surprises in Q1, but will it be equally tolerant with valuations at record levels? Market multiples contract when profits disappoint. Today's market multiple of 30 doesn't feel or look right.

Comments