QE & The Assetization of the US Economy---It Is Bigger Than The Previous Two Asset Bubbles

- Joe Carson

- Jan 18, 2024

- 2 min read

The US has experienced two asset bubbles in the last twenty years, and a third one, bigger than the prior two, has been underway for a few years. Yet, unlike the previous two, which were a function of investor optimism about new technologies and easy credit conditions and the belief that housing prices never fall, the current asset cycle is a function of monetary policy.

The Federal Reserve's influence in the financial markets has grown substantially since the Great Financial Crisis. The increased influence stems primarily from their new financial tool, quantitative easing (QE), or the purchases of debt securities. QE lowers interest rates (making the future value of equities relative to interest-bearing securities more attractive) and increases the demand for risky assets (mainly equities) by removing the supply of safer debt securities.

The Fed never fully reversed its first QE program before another adverse event (i.e., the pandemic) triggered a second and even more extensive program. At its peak in 2022, the Fed's holding of debt securities topped $8.5 trillion, up from $3.8 trillion before the pandemic, and currently stands at $7.2 trillion. This has had a ratchet effect, lifting asset values far above fundamental values, and the positive impact remains in play.

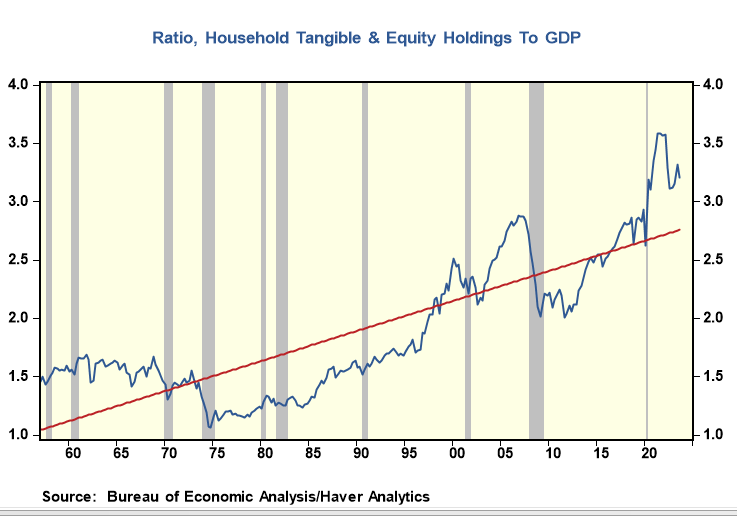

Determining when asset values are running counter to underlying fundamentals is difficult. Yet, one can get perspective by comparing current valuations to past periods.

Since QE's second program in 2020, the market valuation of tangible and equity assets relative to GDP has increased from 2.5 to 3.3 times. The latest reading is for Q3 2023. Given the surge in equity prices in the fourth quarter, the ratio of assets to GDP could come close to its record high of 3.6 at the end of 2021. By comparison, this ratio peaked at 2.9 during the housing bubble and 2.4 in the tech bubble.

The prior two asset bubbles were pricked or unwound by market forces. The tech bubble burst when hundreds of new start-ups ran through their capital and failed to become profitable. The housing bubble burst when people had to refinance at higher mortgage rates, and speculators could not unload the homes they bought.

Yet, how does an asset bubble burst when a non-market buyer like the Federal Reserve drives it? The 500 basis point increase in official rates would have had a much more significant and sustained negative impact on equity and housing markets if QE did not exist on the scale it does.

Critics of QE have always focused on its impact on reported inflation. QE does cause inflation, but not the one that shows up in the CPI or PPI. It is asset inflation, pure and simple. So, the Fed should study the impact of QE on its financial stability mandate, not its inflation and employment mandates.

Monetary policy can make things appear better or run longer. Still, even though there is no law of gravity in finance, recent history does show financial euphoria not grounded in solid economic fundamentals is not sustainable. The significant over-valuation of tangible and financial assets poses a substantial risk to the economy, and history says it's not if but when it will unwind.

Comments