QE Breaks the Link Between Inverted Yield Curve & Housing Construction

- Joe Carson

- Jun 22, 2023

- 1 min read

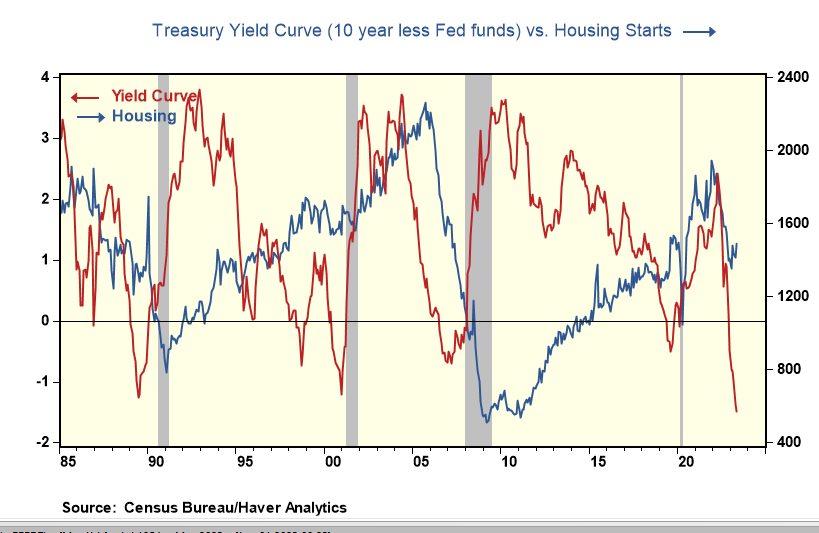

An inverted yield curve is associated with a restrictive stance on monetary policy, which usually spells trouble for housing construction. In the past 40 years, the only time housing construction did not collapse when the yield curve inverted was in 2000. Back then, there was a massive portfolio shift from financial assets into tangible assets triggered partly by easy money as the Fed was dealing with the clean-up following the collapse in tech stocks.

Once again, housing construction is diverging from the inverted yield curve. Why? The Fed's new policy tool QE keeps long-term rates lower than what otherwise be the case. The Fed is in a pickle. Unless the Fed accelerates the shrinking of its balance sheet to lift long-term rates to 5%, it has no choice but to raise Fed funds to higher and higher levels. Is a 7% Fed funds rate on the horizon?

Comments