Policymakers Inflation Mistake #2: Targeting Too Low Of A Neutral Policy Rate

- Joe Carson

- May 11, 2022

- 2 min read

Policymakers misread the nature of the inflation cycle. And, they are making an even bigger mistake by thinking the so-called neutral policy rate is similar to before the pandemic.

A neutral policy rate is not stable or fixed based on the Fed's arbitrary price target of 2%. Yet, Minneapolis Federal Reserve Bank Neel Kashkari recently stated that his nominal "neutral" Fed funds rate estimate is 2%. And the range of estimates by other Fed members is from 2% to 3%.

A neutral policy rate can't be 2% or even 3% when inflation runs much higher as it is today. So before policymakers can make the case that the "neutral" policy rate is between 2% and 3%, they first need to reverse the inflation cycle. And based on the April consumer price data, they have a lot of tightening to do.

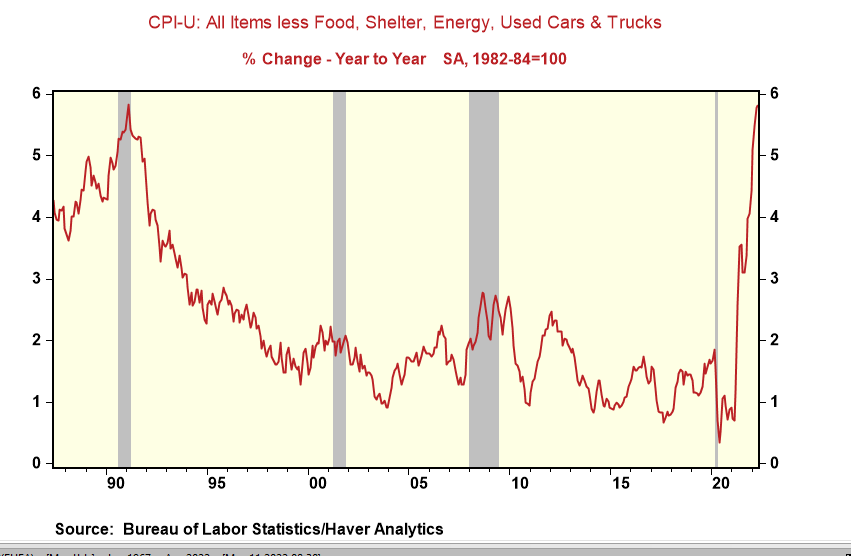

The Bureau of Labor Statistics publishes a series of CPI less food, energy, shelter, and used car and truck prices. This series helps remove some of the price noise that shortages have created. And it offers perspective on the breadth and scale of the inflation cycle that policymakers need to reverse.

This dumbed-down price series showed a month-over-month increase of 0.7% in April, above the 0.6% gain recorded in March, and has increased 5.8% in the past year, matching the highest rate recorded in 40 years. That should be the reference point when policymakers consider how much tightening is required to break the inflation cycle.

Policymakers operate in a different world nowadays. As bad of a policy mistake, it was misreading the true nature of the inflation cycle; it would be much worse if policymakers set their sights on a policy rate too low to reverse or kill the inflation cycle. Instead, that will keep the inflation cycle running hotter and longer, with more wrenching policy and economic adjustments later.

Comments