OUCH: Q1 S&P PROFITS POST RECORD DECLINE

- Joe Carson

- May 25, 2020

- 2 min read

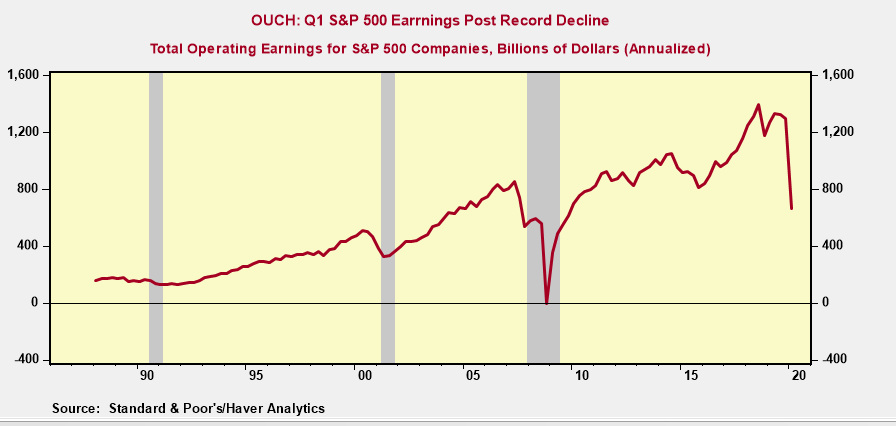

S&P 500 companies posted a record decline in Q1 operating profits, exceeding the previous single large quarter collapse that occurred during the Great Financial Recession.

The decline in Q2 operating profits will prove to be far bigger. Corporate solvency risks are alive and growing. Equity valuations are at nosebleed levels. A retesting of the March lows in the equity market is a probable outcome.

Q1 S&P 500 Profits--- Record Plunge

In Q1, operating profits for S&P 500 companies are estimated at $661 billion annualized, a record drop of $637 billion, or 50% from Q4 2019. The level of Q1 2020 S&P 500 earnings stands at its lowest level since Q4 2009, more than a decade ago.

The drop in Q2 operating profits is projected to be far worse. The plunge in sales and production in Q2 is a multiple of what happened in Q1. The GDP-Now forecast from the Federal Reserve Bank of Atlanta puts the Q2 GDP decline over 40% annualized, nearly 10 times the Q1 GDP decline of 4.8%.

If Q2 S&P 500 earnings merely match the dollar decline in Q1 the back-to-back quarterly declines would wipe out more than $1.3 trillion in net income of the US largest companies. And, based on the current level of the S&P 500 index the four-quarter trailing price-to-earnings ratio at the end of Q2 2020 would exceed the nosebleed tech-bubble levels of 2000.

Estimates of S&P 500 operating profits represent a sum of company earnings reported on a per-share basis and then are aggregated based on the number of shares outstanding.

S&P profits are not strictly comparable to the operating profits figures in the GDP report. Companies use a financial accounting framework, whereas the GDP measure of profits is based on a tax accounting framework.

One of the biggest differences between the two accounting measures is that financial accounting allows companies to include capital income gains and losses, whereas the GDP measure excludes income (or loss) from the sale of an asset.

The Bureau of Economic Analysis (BEA) will publish its first official estimate of Q1 operating profits when it releases its second estimate on Q1 GDP on Thursday May 28. The GDP profit figure will exclude any capital losses in Q1, but it will include the operating results of a small and mid-sized business, many of which were hurt even more so than S&P 500 companies.

Investors believe that a policy of easy money and excessive liquidity have squashed corporate liquidity and solvency risks. That's a false narrative. Record collapse in profits and rising debt levels increase solvency risks. Companies cannot be profitable without being solvent. Once the reality of the record plunge in corporate profitability and solvency risks sets in the equity market could retest the lows of March.

Comments