Nominal GDP Running At Its Fastest Rate Since Mid-1980s---Fed Funds & Market Rates Still Too Low

- Joe Carson

- Oct 26, 2023

- 2 min read

Updated: Oct 26, 2023

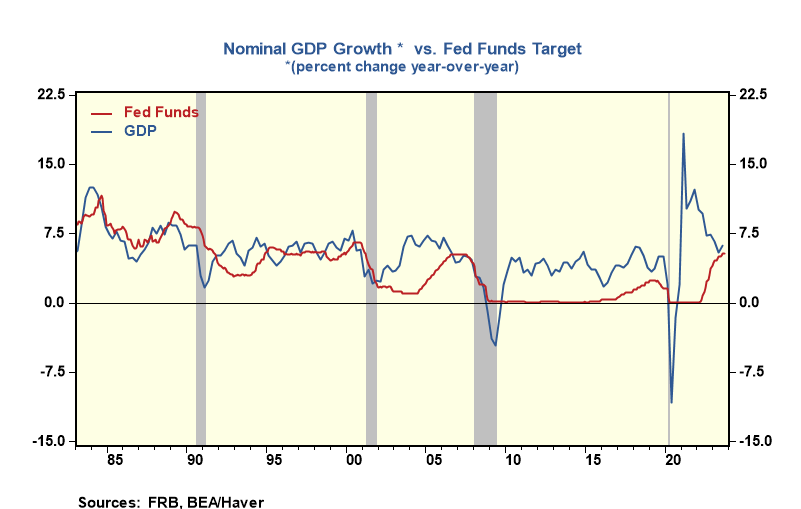

Monetary policy influences nominal spending in the economy. In the third quarter, nominal GDP grew 8.6% annualized. So far, in 2023, nominal GDP is running at an annualized pace of 6%. That follows a 10.6% gain in 2021 and a 9.1% gain in 2022. The three-year increase, 2021 to 2023, represents the fastest three-year advance in nominal GDP since the mid-1980s.

The economy's nominal growth performance has two critical messages/implications for policymakers and analysts/portfolio managers regarding Fed policy and market rates.

First, except for the non-economic slowdown following the pandemic, it has taken a Fed funds rate equal to or above the growth in nominal GDP to engineer a sustained growth slowdown/recession. The target on the Fed Funds rate is still 75 basis points below the growth in nominal GDP.

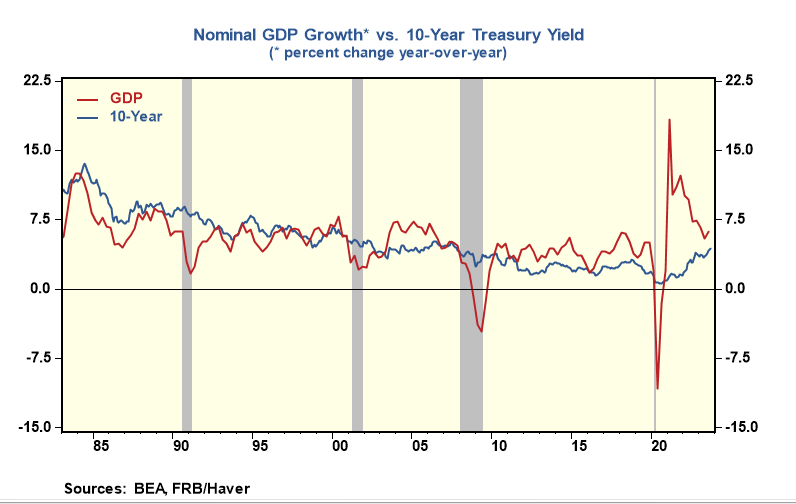

Second, many analysts and portfolio managers still expect a return soon to the interest rate pattern of 2008 to 2020. Yet, that interest rate pattern was abnormal, as was the nominal growth path in the economy. Only once did nominal GDP grow more than 5% during those twelve years, which occurred in 2018. The average gain was about 4%.

The interest rate pattern more applicable to the economy's current growth performance and policymakers' intent to lower inflation is from the mid-1980s to the mid-1990s. At the start of that period, the Fed funds rate, as did the 10-year Treasury yield, exceeded the Nominal GDP growth. Then, in the later part, nominal growth and nominal rates were more in line with one another.

The longer it takes the Fed to adjust policy to the current growth dynamics, the longer it will be before the economy slows and market rates fall.

Comments