New Fed Policy: Soft Inflation Target & Only Tightening Financial Conditions Matter

- Joe Carson

- Dec 14, 2023

- 3 min read

Fed Powell changed or altered the narrative on two policy points this week. The remarks were a sharp departure from what was said, or implied, before such that Fed Powell can be accused of committing a Greenspanism: "I know you think you understand what you thought I said, but I'm not sure you realize that what you heard is not what I meant."

For the past two years, Fed Powell said the priority #1 is to get inflation back to 2%. Many viewed that to mean 2% inflation was a hard target. Yet, at the press conference following the December 12-13 FOMC meeting, Powell stated, "You wouldn't wait to get to 2 percent to cut rates ... it would be too late... you'd want to be reducing restriction on the economy well before 2 percent because -- or before you get to 2 percent so you don't overshoot."

So, 2% inflation is an objective or a goal, not a hard target. In 2020, policymakers changed their longer-run policy objectives to achieve 2% inflation over time, and any shortfall below 2% would allow inflation to run over 2% for some time. Yet, any over-shoot, according to Powell, does not require a similar response or a sustained high-rate policy.

Fed Powell has often stated, "A tightening in financial conditions would work in the same direction as rate tightening." And, two market-driven events in 2023--- the collapse of the Silicon Valley Bank triggered worries over an abrupt tightening in lending standards and reduced credit availability, and more recently, a 100 basis point in long-bond yields triggered concern over an abrupt tightening in financial conditions---so much so Fed Powell mentioned them at press conferences following the FOMC meetings in March and November and said that they influenced their policy decisions.

But what happens when inflation is running above target, the unemployment rate below target, and there is an unintended market-driven easing of financial conditions? Not much.

Powell stated at this week's press conference, "It's important that financial conditions become aligned or are aligned with what we're trying to accomplish." How is a 100 basis point drop in long-term rates, bringing them below current core inflation, and a double-digit gain in equity prices in the last eight weeks aligned with what the Fed is trying to achieve?

The Fed relies on the financial markets to believe that a policy stance will be maintained long enough to achieve the intended results. For the past two years, Powell has repeatedly stated that the FOMC "is strongly committed to its 2% objective" and used tighter financial conditions to get the desired results.

So, if tighter financial conditions were important to slow inflation, why isn't the reversal or dramatic easing in financial conditions a worrisome event for policymakers?

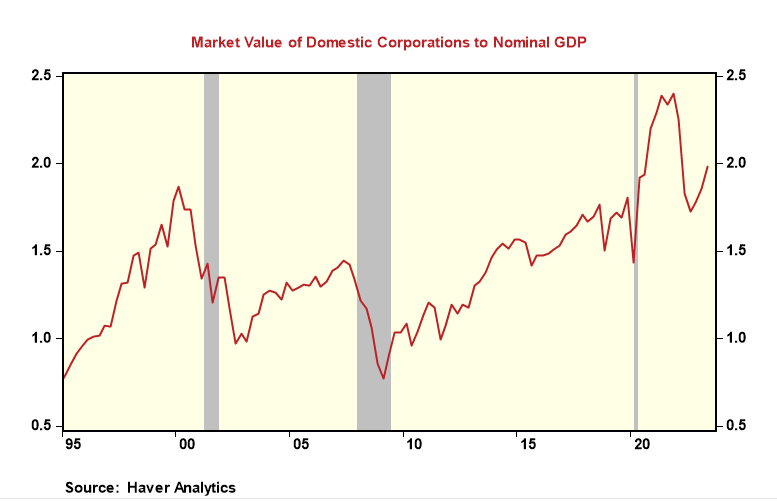

A major flaw in policymaking is the lack of symmetry on how policymakers react to inflation over and under 2% inflation and easier and tighter financial conditions. It would not be a surprise if easier financial conditions trigger faster growth and higher-than-expected inflation in 2024 or a further rise in equity asset value, lifting the market valuation of domestic equities relative to GDP even further above the peak of the tech bubble. At some point, don't be surprised if Powell utters another Greenspanism: "How do we know when irrational exuberance has unduly escalated asset values?" By some measures, it already has ( see chart).

Comments