Near-Record High-Profit Margins Indicate the Fed Is Not Winning the Inflation Battle

- Joe Carson

- Oct 19, 2022

- 2 min read

The resiliency of the corporate sector has been one of the surprises in 2022. Despite a volatile and uneven economy and a series of interest rate hikes from the Federal Reserve, the corporate sector has maintained record profitability and near-record profit margins. The high-profit margins may be the biggest surprise as it confirms that cost increases have been passed along and not absorbed. That dynamic makes the Fed's job of slowing inflation much more difficult, as it shows an "acceptance" of price increases.

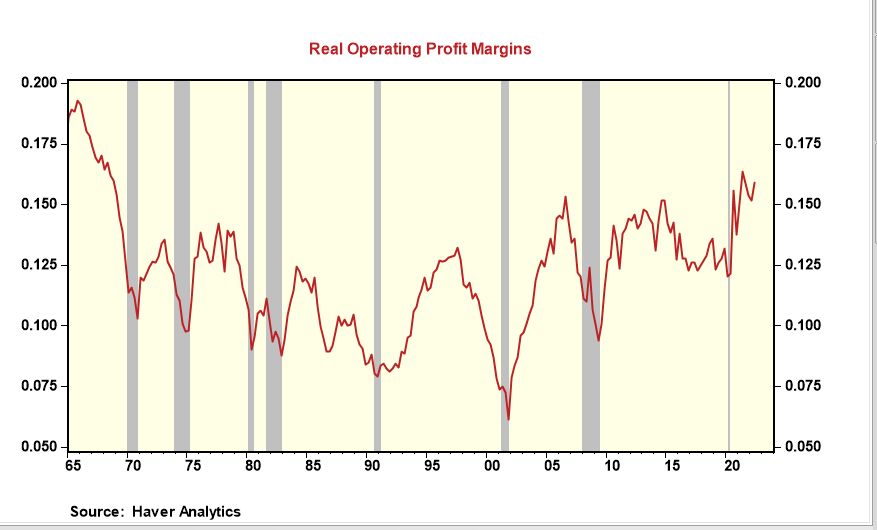

In 2021, real operating profit margins for nonfinancial companies stood at 15.7%, the highest level since the mid-1960s. Surprisingly, companies simultaneously passed along the higher costs of materials, supplies, and labor and lifted margins in the process. And the spread of 275 basis points between final prices and total unit costs was the second widest since the 1960s.

Real operating margins have remained relatively high in the first half of 2022. At 15.5%, real profit margins for nonfinancial companies are still 300 basis points above the levels that were in place before the pandemic.

Q3 data on profit margins are not yet available. But, the price and wage data suggest margins held up if not expanded. To be sure, core consumer prices of 6.4% annualized and core producer finished goods prices of 7% were 100 to 175 basis points over the increase in wages for non-supervisory private workers. Firms' total unit costs were probably lifted somewhat due to rising finance costs.

High-profit margins help to explain why job growth has continued to be so strong this year. Companies added over 1 million workers in the third quarter, about the same number as in the prior quarter. That robust pace of hiring is not something that one would expect if companies, in the aggregate, were experiencing intense downward pressure on margins from rising costs.

Policymakers will never publicly admit this, but the Fed wants an environment where companies cannot pass along cost increases into final prices. That would lead to a decline in margins, a typical outcome during slower growth periods or recessions, eventually forcing cost cuts, including layoffs, less demand, and slower inflation.

Policymakers place a lot of emphasis on inflation expectations, but that is a "soft-data" measure of what people would like to see or expect versus what they are doing or accepting, as is captured in the "hard data" measure of companies' profit margins. Near-record high-profit margins indicate the Fed's job of fighting inflation is far from over, raising the risk that official rates have to go much higher than is shown in policymakers' dot plots or future prices.

Comments