Monetary Policy, Corporate Debt & Asset Price Boom: Is This A Replay of the Early 2000s?

- Joe Carson

- Feb 18, 2020

- 3 min read

Monetary policy has more direct influence over the cost and availability of private credit than how its policy decisions affects the economy's ability to generate inflation. Yet, policymakers treat private credit as a sideshow to inflation.

Policymakers were wrong to ignore the record buildup of mortgage debt in the 2000s cycle and the attendant surge in real estate prices and appear to be repeating the mistake again by overlooking a record build-up of nonfinancial corporate debt with soaring equity prices in the current cycle.

Monetary policy has multiple goals and setting policy to one specific goal can create imbalances in other equally important areas. Are policymakers ignoring and possibly even fueling another dangerous credit cycle as they pursue an arbitrary inflation rule?

The Channels of Monetary Policy

It was not too long ago that the growth of credit was an important channel for monetary policy. In fact, maintaining growth in credit along with money were cited in Federal Reserve Reform Act as the principal channels policymakers were to use to achieve their dual mandates.

Even though policymakers in recent years have downgraded credit growth as a policy indicator, it nonetheless remains a key channel, if not the most important one, for how monetary policy directly affects finance and the economy’s performance.

In the current cycle a credible case can be made that nonfinancial corporations are on similar unsustainable credit track like households were in the prior cycle.

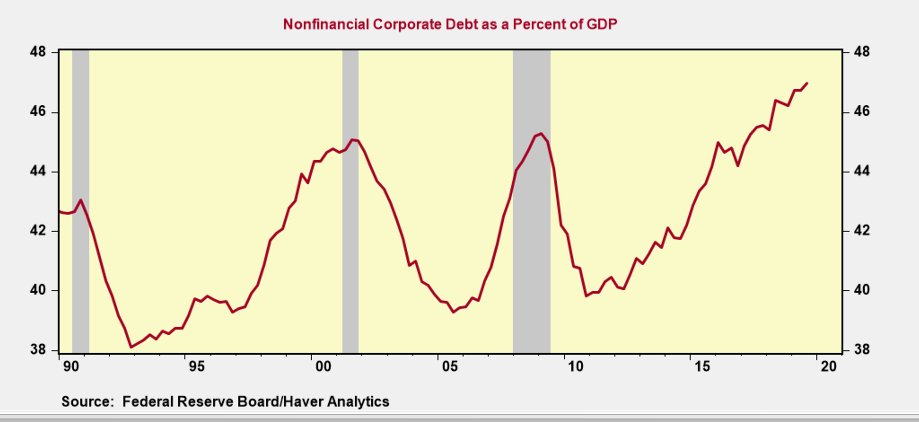

Since the start of the current economic cycle in 2009 nonfinancial corporations have added $4 trillion to their balance sheets, lifting the total debt load to over $10 trillion. At the end of 2019, nonfinancial corporate debt stood at a record level of 47% of GDP, surpassing the prior records reached at the end of the tech equity bubble and the Great Financial Recession.

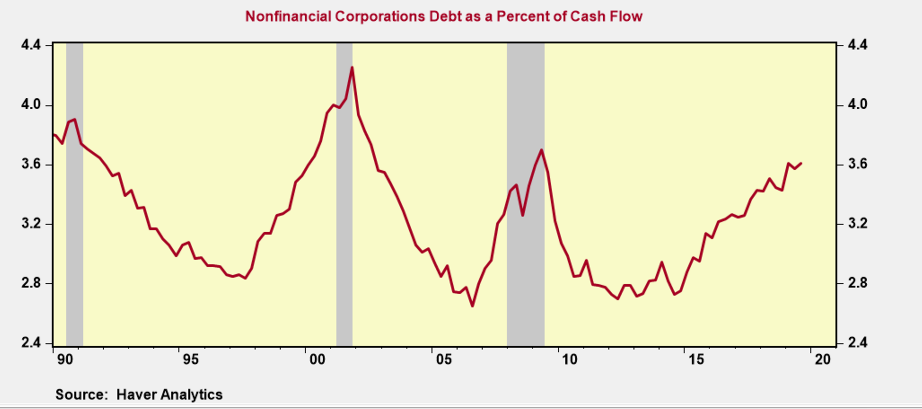

Equally troubling is the surge in debt relative to cash flow and operating profits. At the end of 2019, the ratio of outstanding debt to cash flow is estimated at 3.6x, or roughly 500 basis points above the level that was in place prior to the start of the Great Financial recession.

Operating with very high leverage makes nonfinancial companies very vulnerable to any slump in revenue and earnings. In fact, in each of the past two recessions the ratio of debt to cash flow jumped by 500 basis points, owing to the sharp drop in profits while debt levels remained essentially unchanged. If that were to occur again on the same scale the debt to cash flow ratio would nearly equal the record levels of tech-equity bubble---a level that triggered a surge in defaults and a three-year deleveraging cycle in the corporate sector.

Credit cycles reflect an expansion in credit supply, as credit is extended to a riskier set of borrowers. Monetary policy facilitates the process with the formal setting of official rates and also in the communication of its policy objectives. In the current cycle monetary policy has promoted the expansion of credit in a number of ways---through its policy of very low official rates, commitment to keep official rates at low levels, and asset purchases that increased overall market liquidity.

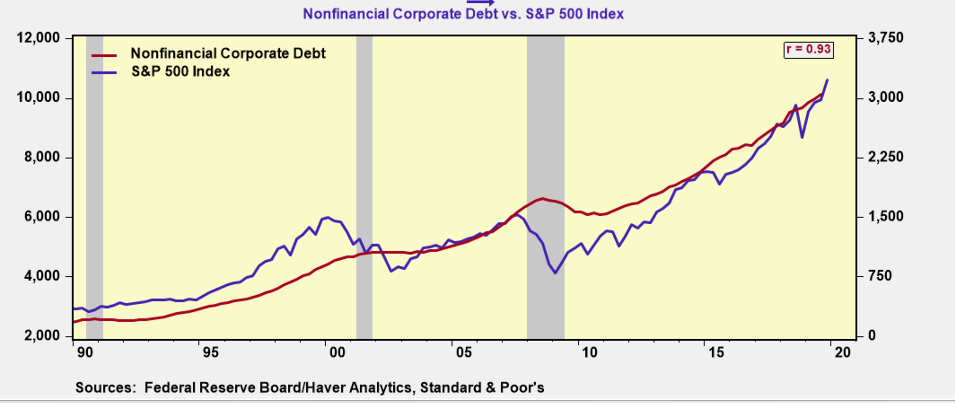

The expansion in credit supply has enabled a lot of riskier corporate borrowers to gain access to debt, and at relatively low rates. And at the same time low borrowing costs has also enticed companies that were not in need of credit/money to borrow to finance stock buyback schemes. It has been estimated that more than half of the $1.5 trillion in stock buybacks of the past two years were funded by debt.

Stock buyback schemes of corporations are different than the home equity loans of the 2000s, but both schemes have a similar result. Firms nowadays are borrowing large sums of money to reduce the number of shares outstanding, and drive their share price higher. Households, in contrast, borrowed money against the equity value of their home. Both actions, however, result in a much higher level of debt on the balance sheet of the private sector thereby increasing the financial fragility of the system.

The negative effects of high levels of debt are well known and the build-up of debt at the nonfinancial corporate level should raise alarm bells among policymakers, especially when they are also linked to an asset price cycle. In fact, asset price cycles have been shown to be a reliable signal for detecting whether high debt levels end in a bad way.

Yet, for now policymakers are relying on an untested single policy rule to guide them on the proper course of monetary policy when in the past the best assessment of policy was a broad set of indicators with credit growth being one of them. One of the potential problems with a single rule is that enables businesses, financial firms and investors to predict future policymakers behavior fairly accurately thereby taking on more risk (and debt). Thus, the big risk is that a single policy rule could eventually become a destabilizing force when used in practice---“Are We There Yet”?

Comments