Macro Equity Valuations Highlight A Poor Risk-Reward Ratio & Decade of Anemic Returns Ahead

- Joe Carson

- May 18, 2020

- 4 min read

Macro measures of equity market valuations offer investors a fundamental assessment of the risk-reward ratio in investing at various points in the cycle. Macro equity valuation measures highlight “richness” and “cheapness” in the broad equity market.

History shows that investors who time their entry into the broad equity market at depressed levels of macro valuations far outperform investing strategies that remain fully invested. Current macro valuations indicate a very poor risk-reward ratio for investing in the equity market and the potential for an extended period of anemic returns.

Macro Equity Valuations

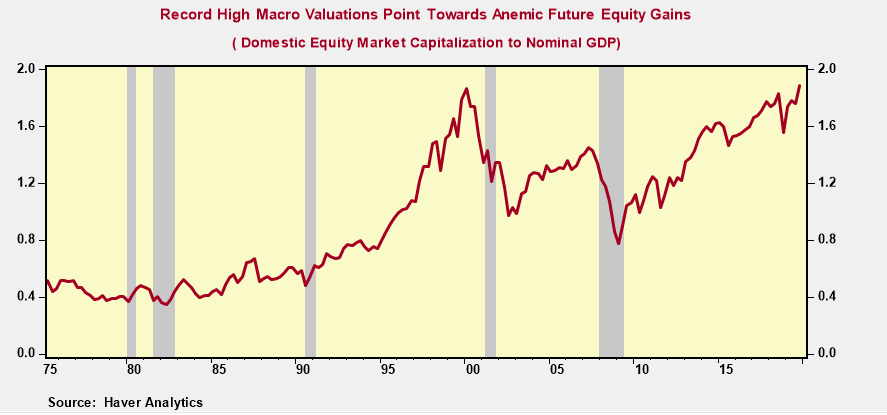

For this analysis, the macro measure used is the domestic market capitalization to Nominal Gross Domestic Product (see chart).

Equity market price returns for the S&P 500 index were calculated based on peak-to-peak and trough to peak in the macro measure for the past 20 years. Quarterly levels of the S&P 500 index were used to match the quarterly peak and trough periods in the macro valuation index.

For investors who remained invested from the macro valuation peak in 2000 to the peak in 2007, the annual rate of return for the S&P 500 was less than 1%, far below the long-run price return average of 7%. Yet, for investors who timed their entry at the trough point in the macro measure of valuation (i.e., Q3 2002) and exited at the peak in 2007 the annual rate of return was a stunning 13%.

The variance in equity price returns was much wider in the cycle that ended in Q4 2019. From peak macro equity valuations in 2007 to 2019 the annual return for investors in the S&P 500 index was 7.7%, barely above the long-run average. However, investors who timed their entry at trough valuation level (i.e., Q1 2009) the average annual return was 13%, nearly double the long-run average of equity price returns.

The wide variance in equity price returns highlights the benefit of timing investment decisions based on broad equity valuation metrics. But the variance in price returns also highlights that equity price returns are not uniform from cycle to cycle and elevated macro valuations in one cycle can lead to anemic returns in the next cycle.

That brings to mind a comment made by Professor Jeremy Siegel, Professor of Finance at the Wharton School and author of “Stocks for the Long Run”, made at an investment event I attended in late 1999. At that event, Mr. Siegel stated that if the S&P 500 went sideways for the next decade, the average annual return for the 20 years ending in 2009 would equal the historic average (i.e., 7%) but all of the gains would have been made in the first 10 years, from 1989 to 1999.

Mr. Siegel was essentially saying it is wrong to extrapolate past equity price performance since equity price returns revert to their long-term mean over time. At the end of 1999, Mr. Siegel was highlighting the poor risk-reward of investing given elevated macro valuations. His warning proved to be correct, as the S&P 500 index equity price returns were negative from 1999 to 2009.

I recently contacted Professor Siegel and asked about his outlook for the equity outlook. I reminded him of his concerns in 1999, the large gains in the last decade, and that macro equity valuations at the end of 2019 were above that of 1999. Professor Siegel commented, “2009 was the most undervalued market in our lifetime”.

That's is true, but I was asking about excessive equity valuations at the end of 2019. Nonetheless, Professor Seigel's assessment of the equity market outlook in 1999 could be used to assess the risk-reward of today's investment outlook since there are a lot of similarities between the two periods. To be sure, if S&P 500 index went sideways for the next decade the average annual return for the 20 year period ending in 2029 would equal the historic average, but all the gains would have been made in the first 10 years, 2009 to 2019.

History sometimes repeats itself in the world of finance. Investor optimism about equities nowadays appears to be over-looking a poor risk-reward ratio, and a long history of price gains reverting to their long-term mean over time.

Will the next decade repeat the negative returns of 1999 to 2009? Based on history alone the odds are high it will. But fundamental factors will also weigh on future returns, as a number of factors point towards slower growth and profits.

For example, the debt-bridge to recovery engineered by the Federal Reserve and US Treasury is structurally flawed as it merely shifts business failures from the recession to the recovery phase and weakens the next business investment cycle. Elevated debt levels in the public and private sector will shift more income towards debt servicing and less towards new spending. Finally, the government's role in the management of the economy and finance will dramatically increase, resulting in greater oversight, new regulations, and higher taxes for business and high-wage earners.

Comments