Long-Run Effects of Budget/Debt Deal Are Not Investor-Friendly: Higher Rates and Taxes Are Coming

- Joe Carson

- Jun 9, 2023

- 2 min read

The budget/debt ceiling negotiation ended like several others; a lot of drama but no fundamental change. The irony is that the primary goal of these negotiations, at the least from House negotiators, was to reduce the staggering debt load of the federal government. Yet, in the end, Congress again decided to vote for more debt, a lot of it, to pay for spending.

The Congressional Budget Office (CBO) projects that the US will run budget deficits between $1.5 to 2.0 trillion per year for the next decade, adding nearly $20 trillion to the federal government's outstanding debt.

Nearly two decades ago, CBO projected the US would run budget deficits in the $200 to $300 billion range, which alarmed former Fed Chairman Alan Greenspan. Back then, Mr. Greenspan stated, "When you begin to do the arithmetic of what the rising debt level implied by the deficits tells you, and you add interest costs to that ever-rising debt, at ever-higher interest rates, the system becomes fiscally destabilizing," he told lawmakers. " What would he say today?

The impact of budget deficits on interest rates varies depending on economic conditions. Yet, huge budget deficits for the foreseeable future will occur as the Federal Reserve reduces its balance sheet, removing the non-interest rate-sensitive buyer that has held down interest rates in the past several years. Market interest rates will have to go much higher to attract private sector buyers, and it would not be surprising if ten-year yields rise 100 to 200 basis points over current levels in coming years.

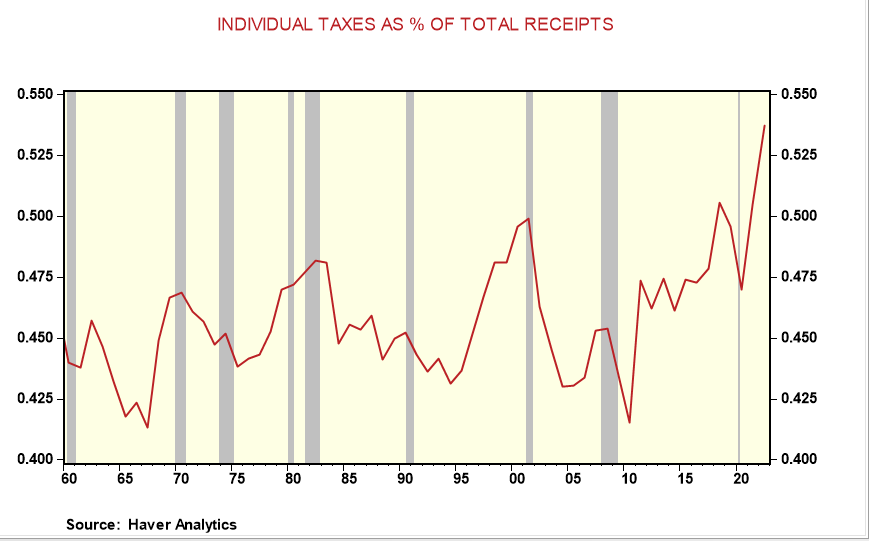

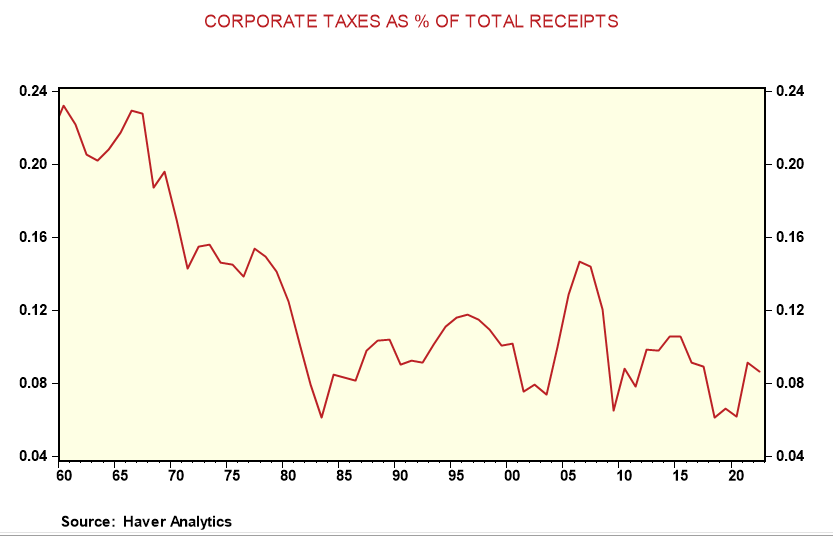

To balance the federal budget requires two things; first, cutting the entitlement programs, and second, raising taxes. Critics would argue against higher taxes, but balancing the budget with tax receipts equaling less than 20%-plus % of GDP (currently running at 18%) is impossible. And since individual tax payments represent a record 50%-plus of total taxes, while corporate tax payments are near a record low of 8%, business taxes are at risk of increasing.

In the past decade, investors have benefitted doubly from Congress's decision to use debt instead of taxes to pay for record spending and the Fed's record purchases of debt securities. Yet, that era is over. The debt deal maintains record federal borrowing, but now without the Fed as a (buying) partner. Investors should expect higher interest rates as a result. And once the higher debt costs become fiscally destabilizing, as Greenspan noted, Congress must move on taxes, with business taxes the target.

Comments