Labor Costs May Be Rising Faster Than Many Think

- Joe Carson

- Feb 1, 2023

- 2 min read

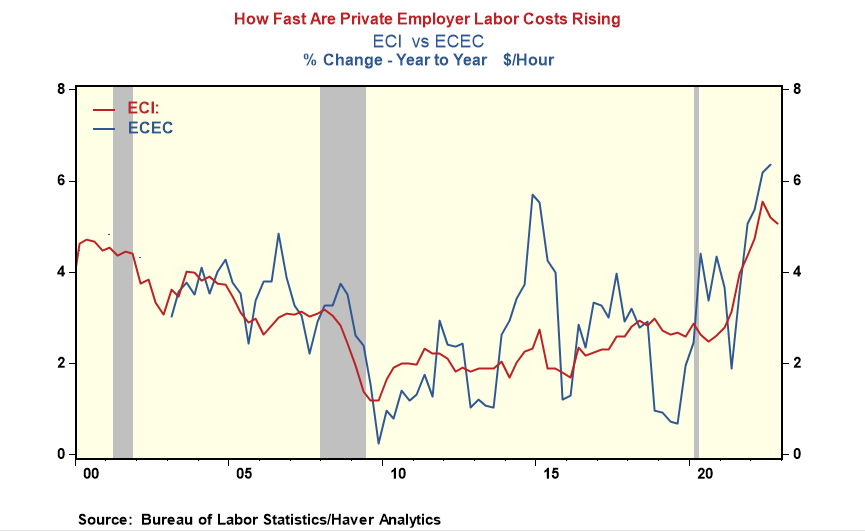

Private employer labor costs may be growing faster than many think. The widely-followed employment cost index (ECI) rose 1% in the fourth quarter, slightly less than the prior quarter's gain of 1.1%. Yet the ECI blocks or excludes compensation increases due to people shifting occupations or industries. Given the exceptionally tight labor markets and the rise in the quit rate, the ECI might be understating the increase in labor costs as people move from one employer to another and one industry to another.

The Bureau of Labor Statistics publishes a companion series on labor costs---employer costs for employee compensation (ECEC). The ECEC series is more volatile and will be released later---for example, the fourth quarter of 2022 data will be available on March 17, 2023. Nonetheless, it offers a complete and comprehensive measure of actual labor costs.

Through Q3 2022, the ECEC series posted a 6.4% increase in the prior year. That represented the fastest twelve-month increase in this series since it started in 2003. Also, the ECEC gain was 120 basis points over the ECI increase, signaling that private sector "actual" labor costs were much higher than many think.

Comparing the ECEC vs. ECI gains by industries, the most significant gap was in the private service industries. ECEC measure of services industries' labor costs showed an increase of 6.8%, 180 basis points above the ECI gain for the same industry.

Fed policymakers are looking at breaking the significant increases in labor costs to help break the inflation cycle, especially in the private services sector. The ECEC series indicates the labor cost hurdle is much more significant than many think, suggesting there is a considerable risk that there will more persistent price increases in the service sector.

Comments