June CPI: Wages Costs More Important Than Commodities & No Sign of Product Discounts

- Joe Carson

- Jul 13, 2022

- 2 min read

The June report on consumer price inflation confirms that the Fed is far behind the curve and carries several important messages to investors:

Consumer price inflation is broad and shows few signs of slowing.

Wage costs are much more critical to inflation than commodities.

High inventory levels at a few large retailers are not representative of the entire economy, nor are they producing discounts on a wide range of products.

The risk of a hard landing grows daily as the Fed needs to do much more to quell inflation.

In June, consumer prices rose 1.3% from May and increased 9.1% in the past twelve months. The last time consumer prices topped 9% for twelve months was in 1981.

Roughly half of the price increase stemmed from higher prices for food and energy. The core price index, or total consumer prices less food and energy, rose 0.7% and increased 5.9% in the last twelve months. That was slightly less than the 6%-plus readings of the past five months.

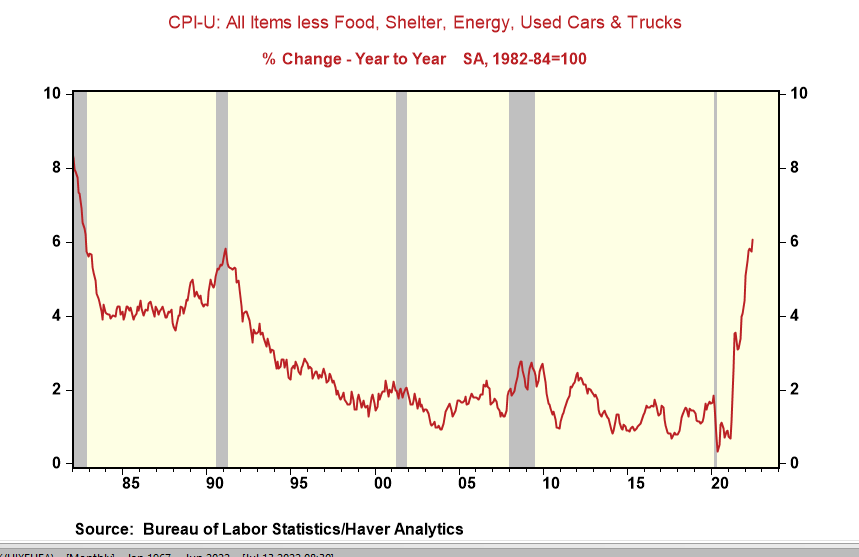

Yet, another broad price index made a new high in June. Consumer prices less food, energy, shelter, and used cars, rose 0.7% in June and increased 6.1% in the past twelve months, a new cycle high. This price index removes more noise from supply shortages and the controversial way of measuring housing costs.

There has been much talk, if not hope, that the high and rising inventory levels at a few major retailers (e.g., Target and Wal-Mart) and falling commodity prices would begin to restrain consumer price inflation for various goods. Yet, the June CPI throws cold water on those views, especially those waiting for product discounts to hold down inflation pressures.

In June, prices for home furnishings, which includes appliances and furniture, rose 0.5%, well above the 0.1% increase in May. Also, apparel prices rose 0.8% last month, up from 0.7% in May and the most significant monthly rise since January. Relatively large price increase for these goods provides hard evidence that wage costs are a much more substantial part of a firm's cost structure than commodity prices and that inventory levels at a few retailers are not always representative of the entire economy.

Even if inflation for these items begins to subside in the coming months, the impact of core inflation will be small and overwhelmed by rising housing costs. The combined weight for home furnishing and apparel is 6% versus 32% for shelter. Shelter costs have risen 5.7% in the past twelve months and should accelerate to nearly 7% in the next year.

The bottom line is that the Fed's fight against inflation is still in its early innings. Fed funds, pegged at 1.5% to 1.75% now, will have to at least double by year-end for the Fed to have a chance to cut core inflation in half in 2023.

Comments