July CPI Had Good & Bad News: Headline Inflation Drops But Core Inflation Remains High

- Joe Carson

- Aug 10, 2022

- 1 min read

Updated: Aug 11, 2022

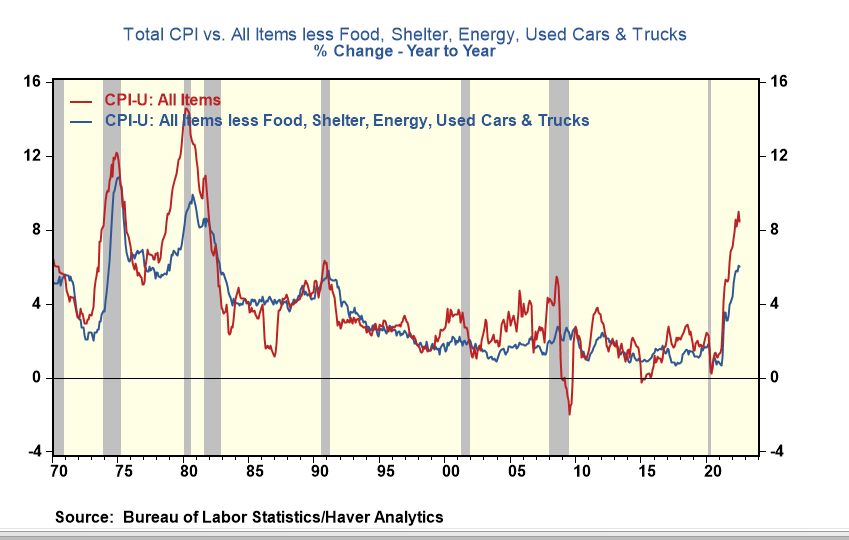

The July consumer price report had good and bad news. The good news is that headline inflation was unchanged in July, bringing the year-on-year inflation rate to 8.5%, down from June's 9.1%. The bad news is that core inflation remained high, with a broad price index running at 6% yearly.

The Bureau of Labor Statistics (BLS) provides special aggregate price series that remove the noise from several unique factors. For example, BLS published a series of CPI less food, energy, shelter, and used car and truck prices. This series removes the recent temporary spikes in food and energy prices linked to the Russian invasion of Ukraine. It also removes the massive spike in used vehicle prices associated with supply bottlenecks owing to the pandemic. On the flip side, it removes the controversial shelter component that no longer captures house price inflation.

This particular broad price index rose 6.04% in July from year-ago levels, down slightly from the 6.08% reading in June. The June reading was the highest since 1982. With shelter-rent prices running hot, nearly 6%, this price series needs to drop below 2% for the Fed to achieve its inflation target.

The jump in the inflation rate to 9.1% in June and subsequent fall to 8.5% in July was energy-related, and Fed policy played little or no role. Yet, the recurring increase of the 6% inflation rate for the core CPI is tied to Fed policy. Thus, the Fed has a long way to go, and a doubling of the federal funds from current levels (2.25%/2,5%) would not be a surprise.

Comments