ISM April's New Orders & Production Crash

- Joe Carson

- May 1, 2020

- 2 min read

Updated: May 2, 2020

The Institute of Supply Management (ISM) composite index for manufacturing fell 7.6 points to 41.5 in April, the lowest level since the Great Financial Recession. As bad as the headline numbers appear at first glance the "internals" of the monthly survey are even more alarming.

In April, the new orders index fell 15 points to 27.1, while the production index fell 20 points to 27.5. In the history of the ISM index, which goes back to 1948, there are only two readings in May 1980 (government-imposed credit controls) and December 2008 (fallout from Great Financial Recession) that recorded combined lower readings on new orders and production indexes.

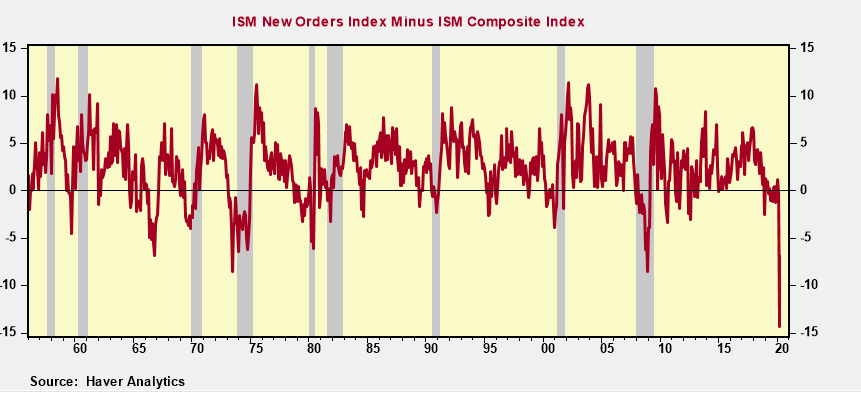

The ISM manufacturing index was initially created in the early 1980s by Mr. Ted Torda, a colleague of mine at that time at the Office of the Chief Economist at the Department of Commerce. The initial launch of the ISM manufacturing index awarded new orders and production components the largest weights ( 30% each). Using the original weights the April 2020 composite index would have dropped to 36.6. (Note: nowadays these two subcomponents along with employment, supplier deliveries, and inventories are given equal weights of 20%). The initial research showed that the up and down movements in new orders and production offered the most accurate assessment of the current state of manufacturing. The April readings on new orders and production indicate that the current state of the manufacturing sector is far worse than what is implied in the overall composite index. And as bad as business conditions are today, firms are saying conditions are not likely to improve in a major way anytime soon. One of the most accurate forward-looking indicators of the ISM survey is to compare the levels of new orders index to the overall composite index. The rule is that when new orders run below the composite index the near term direction of manufacturing is lower/bleaker, whereas when the new order index runs above the composite index the near-term outlook is higher/brighter. In April, the new orders index had a minus -14.4 reading relative to the overall composite. That's the most negative reading in the 70-year plus history of the ISM survey. That record low reading is a way companies saying "current conditions are bad and we have no visibility when conditions will improve."

Comments