Will The Fed's Revised Longer-Run Policy Objectives Weigh On Their Policy Stance?

- Joe Carson

- Dec 11, 2023

- 1 min read

Updated: Dec 12, 2023

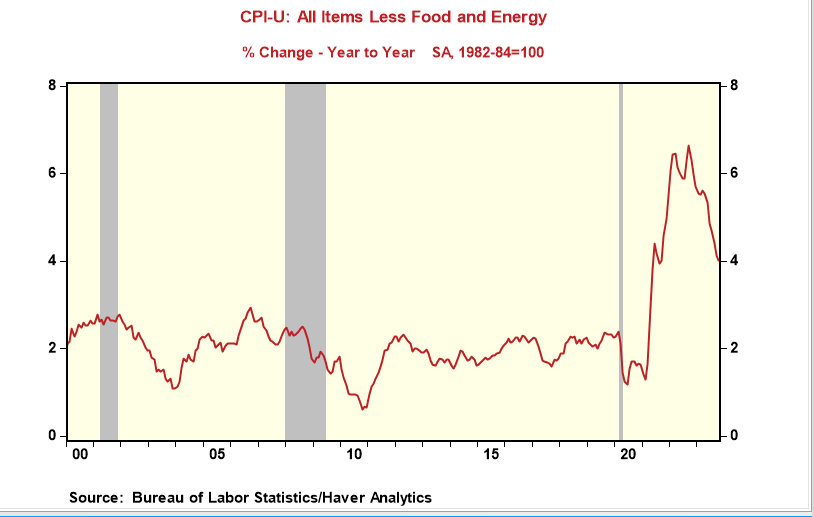

In August 2020, policymakers updated their longer-run policy objectives. The most significant change applied to its price stability mandate. The new price stability objective was to "achieve inflation that averages 2% over time. " Policymakers added that "following periods when inflation has been running persistently below 2 percent, appropriate monetary policy will likely aim to achieve inflation moderately above 2 percent for some time."

Yet, is that pledge symmetrical? When policymakers changed their longer-run policy objectives, core consumer price inflation ran less than ten basis points, or 100 basis points below its target for the prior ten years; however, since August 2020, core CPI inflation has run nearly 900 basis points above a 2% trend rate.

Simple math: A 900 basis points higher inflation deviation for three years is much more significant than a 100 basis shortfall for ten years.

If policymakers genuinely practice what they publically say, maintaining official interest rates at current levels for much longer than the markets expect would be consistent with the longer-run policy objectives of August 2020.

Investors are betting on a lot of "good cheer" from the FOMC, but could the Fed be a "Grinch?"

Comments