Inflation Cycles Are Not Static; They Rotate and Broaden

- Joe Carson

- Sep 13, 2022

- 2 min read

The August report on consumer prices should end the discussion of peak inflation, deflation risks, and the quick end to the Fed tightening cycle. But it won't. The happy prophecy of this inflation cycle ending without a lousy outcome fails to learn from past episodes.

Lessons from past cycles show that inflation cycles are not static or linear; they rotate and broaden. Some items post significant increases in any given month, others smaller ones, and a few none at all. Months later, the composition of inflation could be completely reversed, with items that were not rising at the outset beginning to run faster than others.

Earlier this year, rapid price increases in a few items were mainly responsible for the acceleration in inflation. For example, at the end of Q1, gasoline prices increased 48% from a year ago, used cars 35%, airline fares 24%, and new cars 13%. These price spikes reflected supply shortages and the rebound in demand from the idle days of the pandemic. Much of that inflation has reversed, but the more significant broad inflation cycle lives on.

The Bureau of Labor Statistics (BLS) provides special aggregate price series that remove the noise from these factors, the spike in food prices, and the controversial shelter index. In August, BLS estimated that CPI less food, energy, shelter, and used car and truck prices rose 0.5% in the month and now stands at a new cycle high of 6.3% in the past year. The annual increase is the largest since 1982.

Inflation cycles are complex, with many interconnected parts.

Consequently, taming or reversing the inflation cycle is not as simply slowing or ending the price increases for those items that spiked early on.

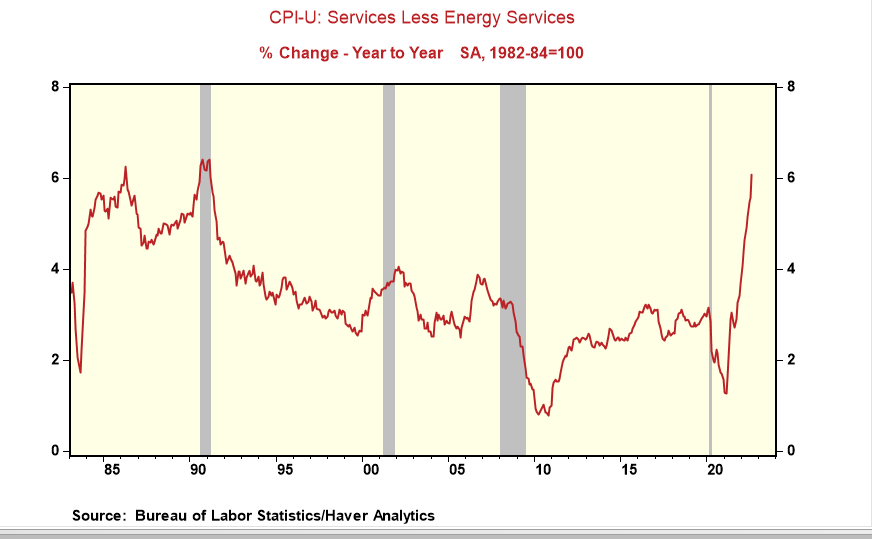

The drop in consumer goods or commodities, especially energy, is good, but inflation in the service sector is much more difficult to eradicate with monetary policy. That's because it is linked directly to labor costs, and labor nowadays is in short supply.

Investors are waking up to the view that the Fed has much more tightening before it can confidently conclude the inflation cycle is over. Policy rates of 4% or higher are possible, given the changing nature of the inflation cycle. And because of that, I am reminded of what a former colleague and Wall Street strategist, Bob Farell, claimed bear markets have three stages, "sharp down, reflexive rebound and drawn-out fundamental downtrend." The last stage can last a while and be ugly.

Comments