Inflation Cycle Shifts Towards Services, Making It More Difficult For The Fed To Reverse

- Joe Carson

- Sep 8, 2022

- 2 min read

At the start of the third quarter, there were 10 million job openings in the private sector, and seventy-five percent were in the service sector. The imbalance in the labor markets, especially for service workers, creates a nightmare scenario for the Federal Reserve. That's because as it attempts to slow demand, dampen wage growth, and cool inflation, its monetary tools are much less effective in dealing with the less interest-rate sensitive service sector.

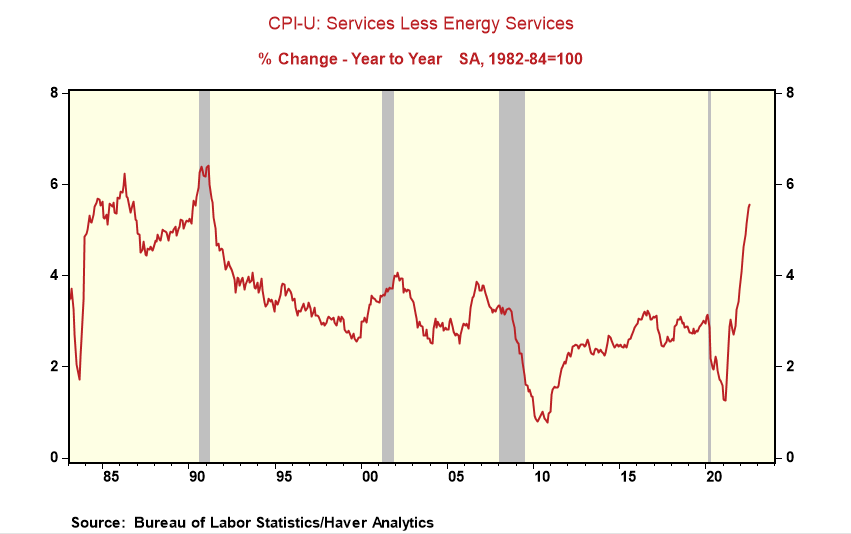

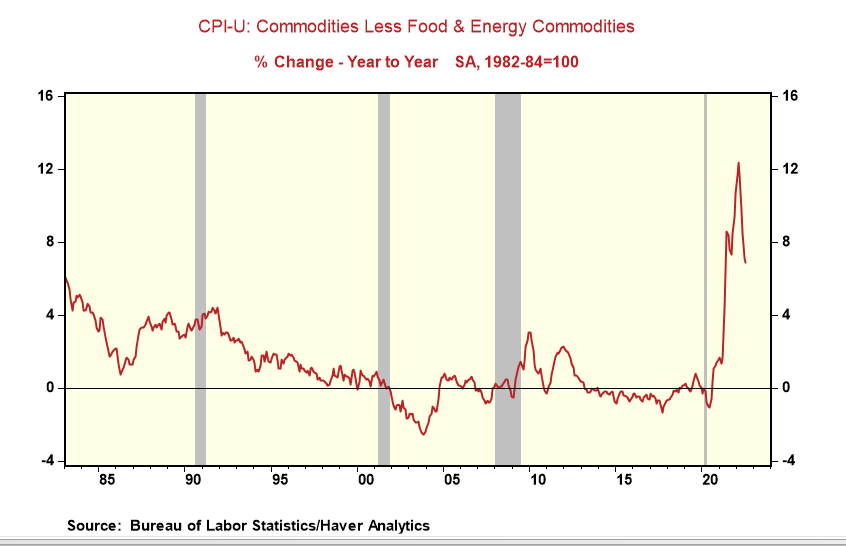

Up to now, the hottest inflation issue was commodities, even excluding food and energy prices. But the composition of the inflation cycle is quickly shifting towards consumer services, making it more difficult to reverse without a dramatic drop in demand due to a prolonged period of higher interest rates.

Core inflation in consumer commodities stands at 6.8%, well off its double-digit highs from earlier than in the year. Yet, prices for core consumer services at 5.6%, the fast annual gain in roughly 25 years, are still accelerating. And core consumer services have nearly three times the weight of core consumer commodities.

Thus, solving the inflation problem requires a fundamental change in service sector growth dynamics. And that cannot occur without a dramatic shift in the demand and price of service sector labor.

Before the pandemic, the private sector service job growth was 1.5 to 2 million per year. So reducing the 7.5 million job openings in the service sector by half would take two years. But that would not mitigate wage pressures, the most significant source of service sector inflation.

The average wages for the private sector non-supervisory service sector workers are up 6.2% in the past year. Excluding the spike in wages in the early months after the pandemic, service sector wages are running at their fastest pace since the early 1980s. And, they are running roughly 100 basis points above the gains in the goods-producing industries.

Private service sector labor and price dynamics are the Fed's most significant hurdles in its inflation fight. Creating slack in the labor market for service workers will require a much official rate and in place for an extended period than it would if inflation was only a goods sector phenomenon.

So Fed Powell's warning that "a lengthy period of very restrictive monetary policy" will be needed to stem the inflation cycle is something investors should not ignore, as it signals a volatile market environment.

Comments