"Implied Irrelevance of Monetary Policy?" Profits Soar, Interest Expenses Fall After Fed Rate Hikes

- Joe Carson

- Dec 7, 2023

- 1 min read

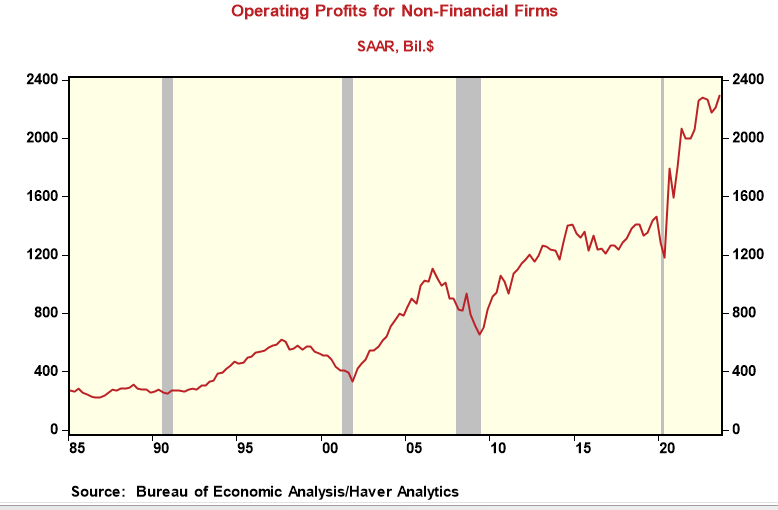

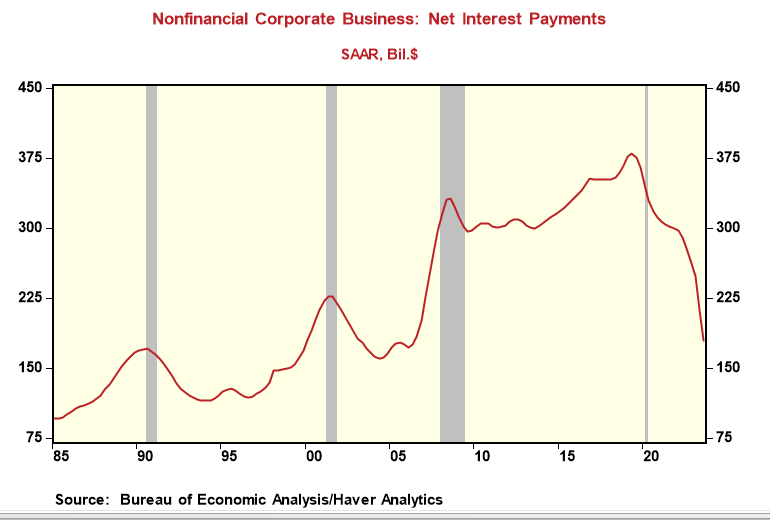

The macroeconomic effects on businesses from the Fed's recent monetary policy actions are unlike before. Even though the Fed raised official rates by 500 basis points over three years, the most significant increase since the early 1980s, operating profits for non-financial companies over the past three years hit a record high, and the percentage increase matches the gain of the prior ten-year cycle. Also, businesses' net interest expenses have been cut in half and currently stand at the lowest since 2005. Every other tightening cycle showed profits decline and interest expenses rise.

Do the results of the past three years' profit and interest expense show the increasing "irrelevance of monetary policy?" Or do the results of the past three years' profits and interest expense show the long-term effects of the Fed's zero interest rate and QE policies?

Policymakers hope it's the latter since that supports their higher-for-longer theme. If it's the former, that implies that "simple monetary policy" (i.e., the movement of official rates up and down) has become irrelevant.

I think the days of "simple monetary policy" are over. Financial markets have become too big, and the increasing sophistication and complexity of financial markets have altered the linkages between rates and businesses. Business cycles are increasingly being driven by asset prices.

Comments