Household Balance Sheet: Which Asset Class Is Most Vulnerable to Fed Tightening & Recession?

- Joe Carson

- Jan 19, 2023

- 2 min read

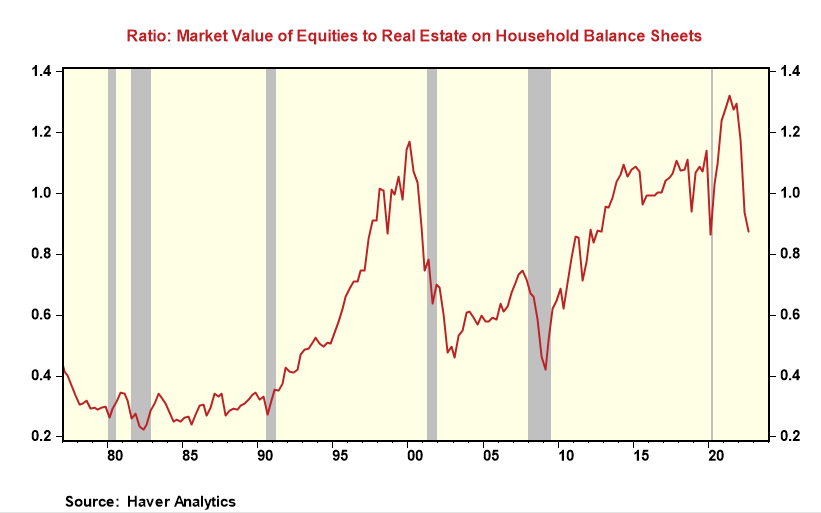

Fed tightening cycles and economic recessions wreak havoc on household balance sheets, triggering sharp drops in real estate and equity values. History shows that household equity holdings (direct and indirectly owned) suffer the most significant loss on a relative basis. And the losses tend to be exceptionally large when equity valuations run far above the norm, as was the case in recent years. Even with the significant fall in equity prices in 2022, the rebalancing of equity to real estate values on household balance sheets has more to run based on the patterns of the last twenty years. But, the wild card is what happens to real estate.

At the end of 2021, the ratio of the market value of household holdings of equities to real estate stood at a record higher of 1.3, exceeding the prior record of 1.15 achieved during the peak of the tech bubble in 1999. Yet, even though, on a relative basis, the high equity valuation of 2021 and 1999 look somewhat similar, significant economic and policy differences make the future uncertain.

For example, when the tech bubble burst, triggering a short recession in 2000, the Federal Reserve responded with an orchestrated drop of 550 basis points in official rates over three years. That easy money policy triggered a flood of money flowing into real estate as households moved from one asset class to another, beginning a string of double-digit annual increases in house prices. As a result, the ratio of equity values to real estate on household balance sheets dropped by two-thirds, the most significant decline ever recorded.

That pattern will not repeat for two reasons. First, the Fed is raising official rates. It also promises to maintain them for an extended period to break the cyclical inflation cycle. It also shows no appetite to reverse course even if the US experiences a mild recession as it did in the early 2000s.

Second, the housing market had already experienced its "boom" phase as it, too, benefitted from Fed's easy money policy. In the past three years, the market value of household real estate holdings has increased by nearly 40%, matching the gains during the first three years of the housing bubble years in the early 2000s.

So since both asset classes experienced a recent boom and higher rates reduce the incentive to shift funds or favor one asset group relative to the other, which asset group fares better in 2023? Housing has yet to feel the impact of a restrictive fed policy, but low inventory and low unemployment should limit the downside. Yet, I am struck by the relative pattern between equities and housing during the 2008/09 period. Even with the most substantial decline in house values in history, on a relative basis, equities fell more. History sometimes repeats itself in finance.

equities.

Comments