Historical "Bullish" Period For Stocks Runs Up Against Fed Tightening Cycle: Will History Repeat?

- Joe Carson

- Oct 30, 2022

- 4 min read

The equity market has had a remarkable record of scoring substantial and consistent gains between the second and third year of a president's term. Yet, this time the transition from the second and third year is running up against a Fed tightening cycle that, based on the past tightening cycles, has more to run. Ironically, both outcomes could occur in 2023.

The Fed's Tightening Cycle---Is the Past A Guide?

The financial markets expect the Federal Reserve to raise official rates by 75 basis points, lifting the target on the fed funds rate to 3.75% to 4% at the November 1-2 meeting. Analysts expect an additional rate hike of 50 basis points for the December meeting, bringing the cumulative total hike in official rates to 425 basis points since the start of 2022.

After lifting official rates by the most significant amount for a single year since the 1980s, it would not be surprising for the fed to pause and assess lagged effects of higher rates on the economy and finance. Yet, if the past is any guide to what the Fed ultimately has to do to quell inflation, then a series of additional official rate hikes are in store for 2023.

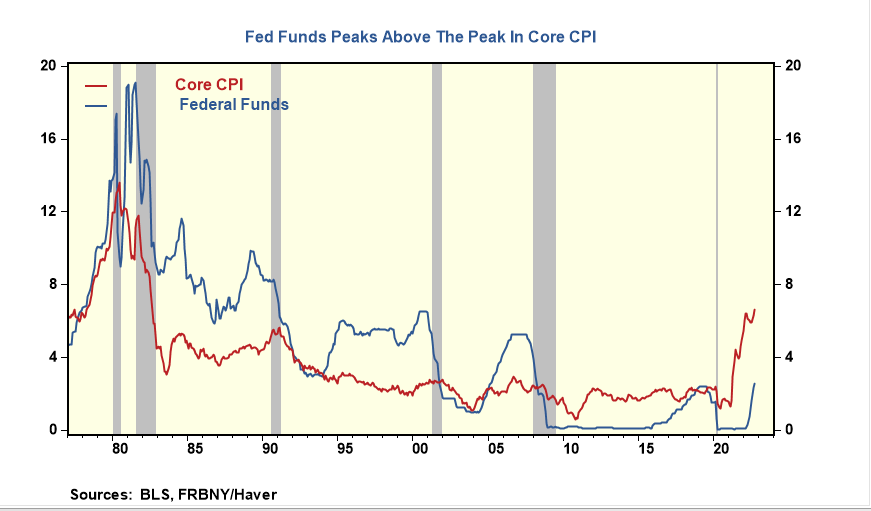

The Fed has had to react to four inflation cycles in the last forty years. None of them, except the inflation cycle of the early 1980s, reached the heights of the current one, with core consumer price inflation rising 6.7% in the past twelve months. Yet, each time the policymakers responded by lifting official rates several hundred basis points above the cyclical high in core CPI inflation. Critics would say that measure is backward-looking, and the financial markets are betting this time is different, expecting the fund's rate to peak several hundred basis points below core CPI.

The pattern between fed funds and core CPI has repeatedly repeated, so it's hard to dismiss. Additionally, policymakers nowadays have an added requirement for a successful outcome in their quest to reverse the current inflation cycle. Policymakers want to dampen the inflation cycle and return it to its target of 2%. Never before has the Fed explicitly linked its policy decisions to a single inflation outcome. That adds additional pressure on policymakers and raises the odds that fed funds will need to go much higher, especially given the tightness in labor markets and that credit growth is still robust.

History Suggests Big Bounce in Equity Markets In 2023 From 2022's Lows

About twenty-five years ago, someone sent me a table showing the percentage gains in the Dow Jones average from the daily closing low in the second year of the Presidential term to the third year's high. There was a remarkable and consistent pattern of substantial gains, so much so that the skeptic in me has kept track of it ever since. And I have concluded that in finance, history often repeats itself.

Before equity investors get overly bullish, expecting a powerful rally in 2023, there are a few things to keep in perspective. First, as of this writing, the daily closing low in the Dow Jones of 28,725 occurred on September 30. And Friday's close of 32,861 represents a 14.3% gain from this year's low. So if Friday's close is also the high mark for 2023, the recurring pattern of increases would repeat, but it would also mean no incremental gains from here.

Second, for the equity market in 2023 to show gains similar to what happened in the third year of the Presidential term from this year's low mark, it would have to jump over 25% from Friday's close. That's possible, but Fed policy would dictate the gains' timing, scale, duration, and if it reverses as quickly as it goes up.

One possible scenario is that the Fed pauses in early 2023 or does one more hike and then telegraphs it has adopted a "wait and see" posture. That could spark a new wave of risk-taking. Alternatively, the Fed could keep raising official rates and reverse course mid-year or later as the economy sinks or the unemployment rate spikes. Neither of these scenarios guarantees a gain for the third year of the presidential term, which is typically the case, but it does create the opportunity for a big bounce.

I'm not an oddsmaker, so it is hard to determine which scenario is more likely. I have seen this equity pattern repeatedly repeat itself to dismiss it outright. The wild card is the Fed's commitment to hit the 2% target. Does Fed adopt an "opportunistic" approach (i.e., accepting a slowing inflation rate over a few years), or do they want to achieve the target in one swoop? The former would be bullish for the equities, while the latter would be bearish. I bet they will accept a gradual slowing in inflation for political reasons.

Equity investors---Good Hunting!

Comments