Hey Fed---Bank Lending Still Accelerating

- Joe Carson

- Jan 20, 2023

- 1 min read

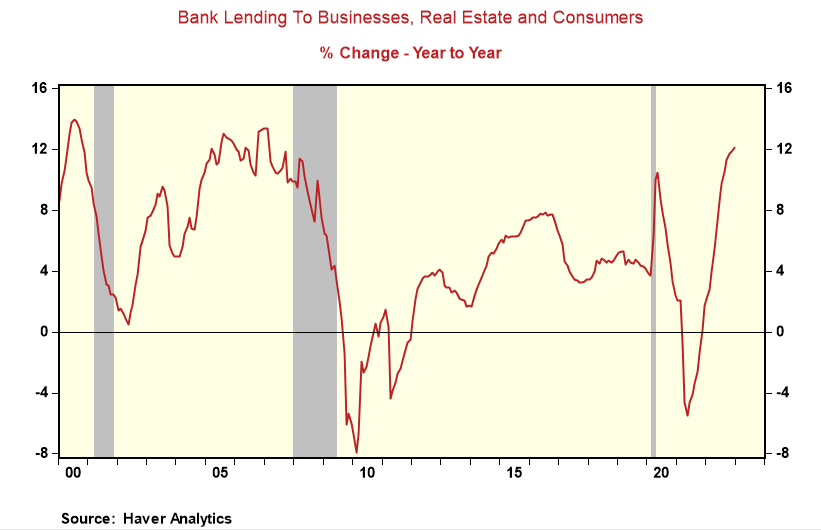

Hey Fed, the tightening of monetary policy ain't working. Bank lending to businesses, real estate, and consumers accelerated to a growth rate of 12.1% in December. That's the fastest calendar growth since 2006. If higher rates don't curtail long growth, history would say that the odds of securing a sustained slowdown in cyclical inflation are low. Does that mean that policy rates will have to go even higher to achieve the policymakers' desired outcome of 2% inflation? Uh-oh!.

Comments