Has The Fed Finished Tightening? Wall Street Says Yes, But History Says No!

- Joe Carson

- Nov 2, 2023

- 2 min read

Has the Fed finished tightening in this cycle? Fed Chair Powell gave that impression at the press conference following the latest FOMC meeting, and investors cheered loudly. But "investor cheering" may be premature if history is correct.

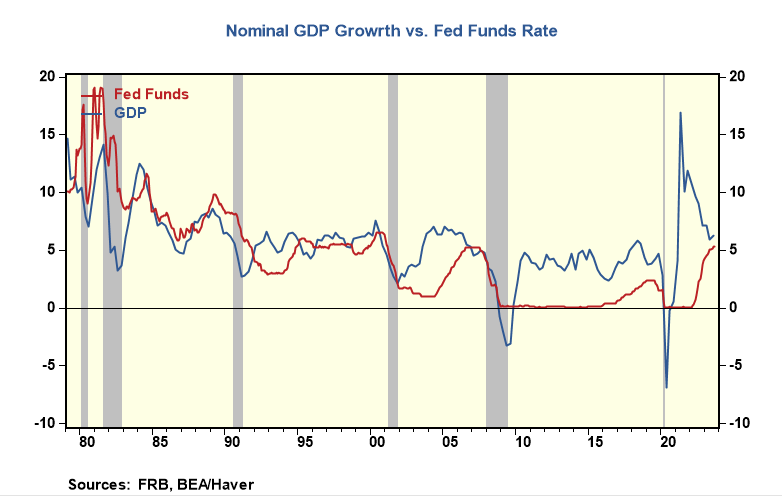

Monetary policy impacts nominal spending, and it influences credit and financial conditions through its impact on market interest rates. Other than the pandemic-driven short recession of 2020, all previous tightening cycles ended when the target on the federal funds rate matched or exceeded the growth in nominal GDP. Through the third quarter of 2023, the Fed funds rate was still 75 basis points below the GDP growth. Equally important, the yield on the 10-year Treasury was equaled to or above the Fed funds rate at the peak of policy rates, and today, they are 75 basis points below. In other words, that's 150 basis points below where it should be based on historical patterns (Is that QE?). In the press statement, the Fed mentioned tight financial conditions as one of the reasons to "pause," but based on history, policy and markets are still relaxed.

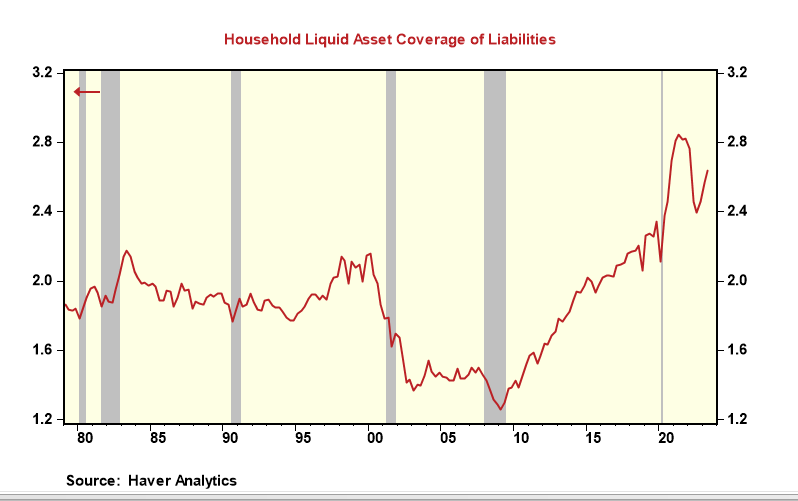

Tightening cycles also impact household liquidity positions. Yet, household liquidity remains ample. Data from the US financial accounts show that household holdings of deposits and direct holdings of equities and debt securities coverage of total liabilities stands at 2.6x times, far above the historical average, and rising. In the prior two recessions, strains on household liquidity were a critical factor in the slump in spending and the weak performance of the general economy. That's not the case today---a strong case could be made that, based on liquidity positions, consumer spending should be surprisingly robust in 2024.

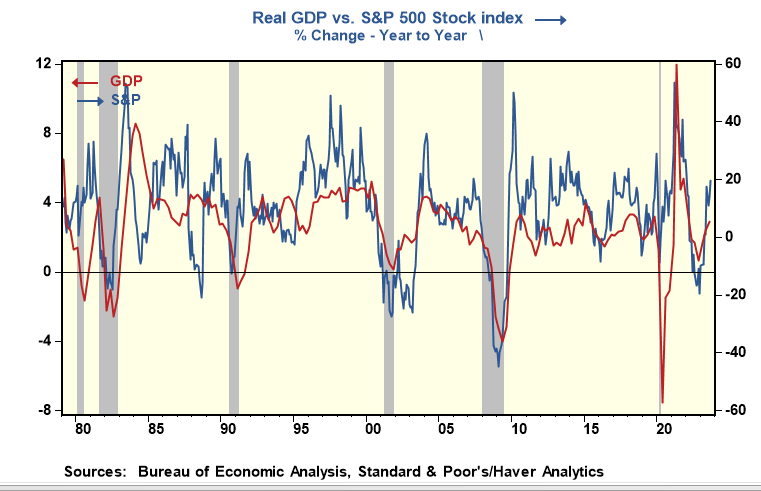

Changes in equity prices often foreshadow economic growth cycles. S&P 500 stock prices are up roughly 20% in the past year. Based on historical relationships between equities prices and real GDP growth, the odds of fast growth in 2024 are higher than for slow growth.

Investors are cheering today, as they should, based on the Fed's dovish stance. But the Fed has been wrong before, especially with inflation and growth forecasts. Last March, only seven months ago, the Fed forecasted 0.4% growth in 2023, and it looks like the economy will grow 2.5% to 3% this year. The Fed's dovish stance today runs the risk of creating the exact opposite financial conditions (too relaxed) it expressed concern about at this FOMC meeting. And history would argue that financial conditions were already relaxed.

Comments