Five Reasons Why The Economy Avoided Recession in 2023: Some Will Be Operative Again in 2024

- Joe Carson

- Dec 3, 2023

- 3 min read

At the outset of 2023, most forecasters, even some policymakers, thought a mild recession was in store for the economy. Yet, the economy expanded at an annualized rate of 3% during the first three quarters and looks to grow somewhat slower in the fourth quarter. What happened? Here are five reasons why the economy beat the odds and did not fall into a recession in 2023.

First, the inverted Treasury yield curve was "artificial." The inversion of the yield curve in the fourth quarter of 2022 was one of the most cited reasons for the recession occurring in 2023, especially with the Fed telegraphing more official rate hikes. But yield curve inversion was a direct result of another Fed policy tool.

Before the Federal Reserve started raising official rates in March 2022, it embarked on the most extensive quantitative easing (QE) program in history, purchasing approximately $4.5 trillion of debt securities in 24 months. The primary purpose of QE is to keep long-term interest rates (one side of the yield curve measure) lower than otherwise would be the case. Some analysts estimated QE was the equivalent of 150 to 250 basis points of Fed easing. Even today, the Fed's balance sheet is approximately $3.5 trillion above when they started QE in March 2020.

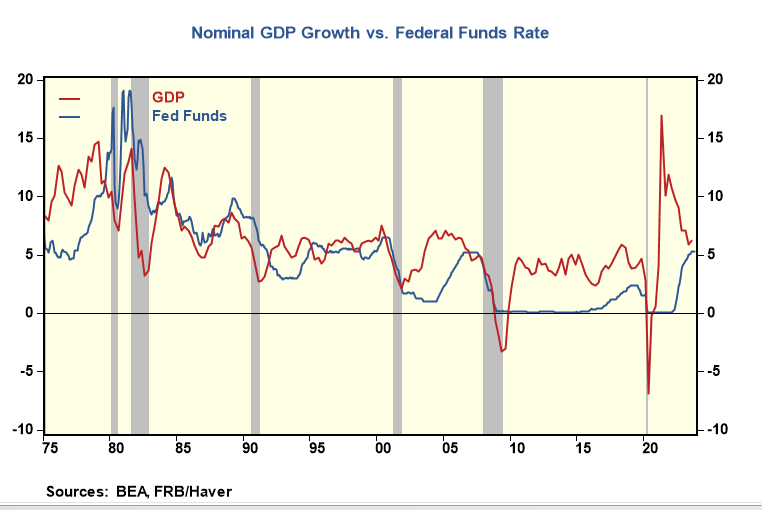

Second, monetary policy was not restrictive. Monetary policy influences the growth of nominal spending. At the end of Q3 2023, nominal GDP growth of 6.3% of the past year was still 100 basis points over the fed funds rate level. There has never been a recession in the past 50 years in which the level of federal funds did not equal or exceed the growth in nominal GDP.

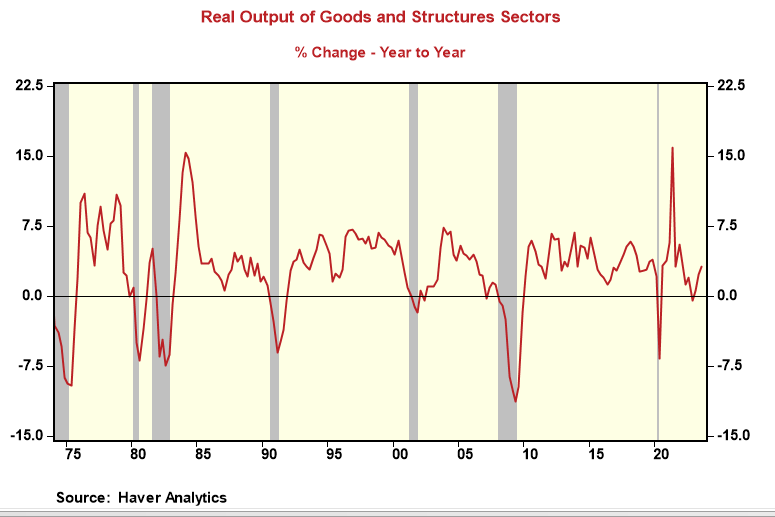

Third, interest-sensitive sectors grew in 2023. The goods and structures sectors expanded each quarter in 2023, hitting a new record high in Q3, with an annualized growth rate of 6.9% and 3% in the past twelve months. If the economy were to enter or be in a recession, it would be most visible in these two sectors as they have consistently contracted during recession periods.

Fourth, labor demand outpaced labor supply. In 2023, the labor market was unbalanced, with the number of job openings exceeding the number of unemployed workers. At the end of Q3 2023, there were 9.5 million job openings or 1.5 jobs for every unemployed person.

Fifth, household liquidity grew in 2023. Based on the current level of equity prices and the rally in bond yields, household direct holdings of equities, debt securities, and deposits are estimated to increase between $10 and $15 trillion in 2023. Fed tightening cycles are supposed to drain liquidity, but that did not happen in 2023.

Many of these factors are still operative for 2024. The most significant positive factors for 2024 are the need for labor and the growth in household liquidity, as both would support continued growth in consumer spending.

The wild card is what happens to official and market interest rates in 2024. If the Fed raises official rates again, market rates could quickly reverse the recent decline in yields. That would have a huge and abrupt negative impact on equity prices and household liquidity; people's equity holdings account for 55% of total liquid assets directly held.

Many factors could trigger a bad outcome in 2024. But those factors need to drain liquidity and trigger contraction in interest-sensitive sectors based on the history of recessions.

Comments