First Quarter Operating Profits Collapse: Q2 Profits Will Drop To Levels Last Seen in 2009

- Joe Carson

- Apr 29, 2020

- 2 min read

Updated: May 1, 2020

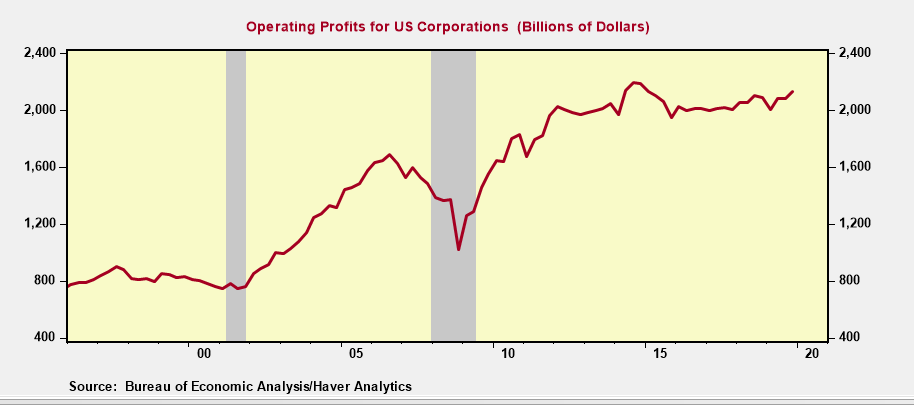

The first-quarter GDP report offers a glimpse of the darkening outlook for operating profits. Based on the preliminary GDP data Q1 operating profits are estimated to be off 14% from Q4 2019 and roughly 10% from year-ago levels. Q2 2020 could easily be twice as bad, resulting in overall profits dropping to levels last seen a decade ago.

The Bureau of Economic Analysis (BEA) reported that Q1 2020 real GDP declined 4.8% annualized in Q1, the largest quarterly decline since Q4 2008. Nominal GDP contracted 3.5% annualized in Q1, the biggest quarterly decline since Q1 2009.

The preliminary report on GDP by BEA does not include a formal estimate on operating profits. But it is possible to guesstimate a profit figure based on the nominal product and income that is released.

BEA produces two measures of national output, one based on the product data (consumer spending, investment, net exports, and government spending) and the other one based on income data (personal income and corporate profits). In theory, these aggregate measures of nominal output are equivalent, but in practice, there are small differences.

Nonetheless, the margin of error is relatively small and there is enough data in the preliminary GDP report to back into an estimate of operating profits.

Q1 corporate operating profits are estimated to $1.825 trillion, off sharply from the $2.131 trillion of Q4 2019 and the lowest quarterly level since 2011. The 14% quarter over quarter decline in operating profits occurred against a 1% decline (non-annualized) in Nominal GDP in the period.

Based on Q2 GDP consensus projections, off 15% to 20% annualized, operating profits in the current quarter could easily drop 20% to 30% from Q1 levels, pushing profits back to levels last seen in 2009.

The sharp rally in equity markets suggests investors have discounted the near-term plunge in profits and already built a bridge to the other side. Yet, the scale of the decline in operating profits is being overlooked as well as how many companies ---with little earnings and record debt levels---will fall off the bridge before we get to the other side.

Current strategies will inevitably leave parts of the corporate sector with even larger debt burdens that will force firms to sell assets, reduce investment and labor. As such, the economy on the other side of the bridge is unlikely to match investors' bullish expectations.

Comments