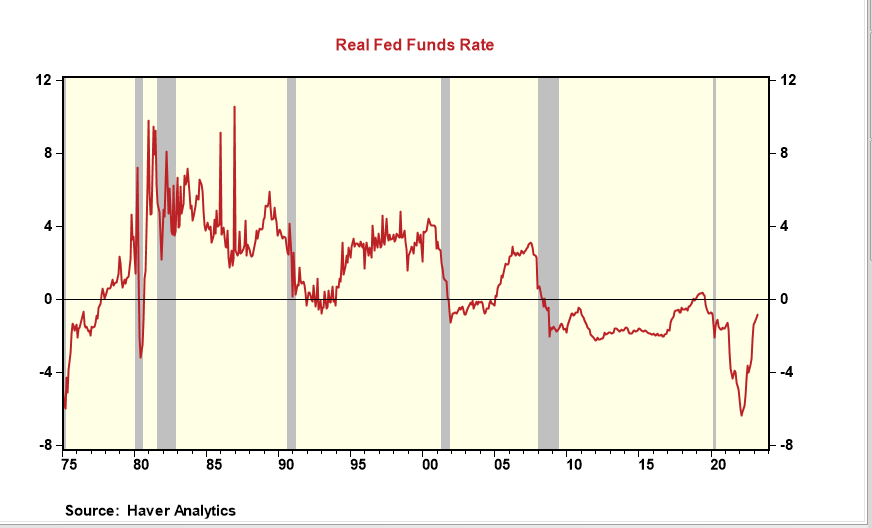

Fed Tightening Cycles End When Fed Funds Exceed Core Inflation By A Lot--- "We Ain't There Yet"

- Joe Carson

- Apr 12, 2023

- 1 min read

Fed tightening cycles end when official rates adjusted for core CPI inflation are positive by a lot. The prior three tightening cycles ended when real fed funds were 300 to 400 basis points. At the end of March 2023, Fed funds less core inflation was minus -75 basis points. History would argue that The Fed still has a long way to go to get real rates prohibitively high to break the inflation cycle.

A banking crisis/credit crunch could alter the scale and duration of the tightening cycle. But the US experienced a credit crunch in the early 1990s, and it still required real official rates of 400 basis points to break the inflation cycle.

The jobs and inflation data for March should compel the Fed to raise the official rate at the May meeting. Afterward, policymakers would make a mistake if they signal a pause with core inflation at 5.5% and the unemployment rate at 3.5%. That's because negative real rates run the risk of reigniting goods/product inflation along with the sticky services inflation, forcing them to return to tightening monetary policy even more later.

Comments