Fed Is Promoting A Public Perception of Inflation That is False----Bad Outcomes Follow Bad Policies

- Joe Carson

- May 16, 2021

- 2 min read

Updated: May 19, 2021

Federal Reserve officials have made a bold claim arguing that the current run-up in consumer price inflation is "transitory," pushed higher due to base effects and a temporary burst in pent-up demand as the economy re-opens. The Fed has no unique insight into inflation dynamics. Puzzlement over inflation dynamics has been a recurring problem for policymakers for more than two decades, and it still is today.

Yet what is puzzling and misleading about policymakers' current take on inflation is that it ignores the monetary role in inflation cycles. And equally puzzling and deceptive is calling the inflation cycle "transitory."

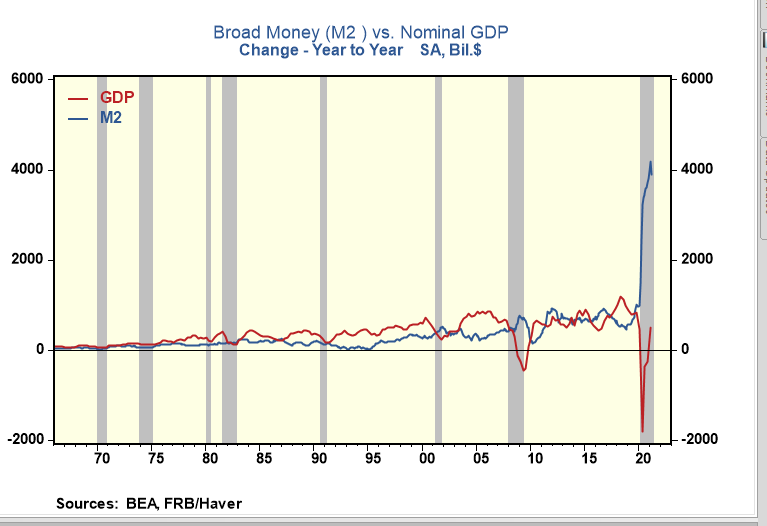

The Fed's primary business is making money, and that's important because the Fed maintains "inflation is always and everywhere a monetary phenomenon." In the past year, broad money (M2) has increased by $4 trillion, or over 20%. The scale of growth in broad money has been so large it exceeded the cumulative change in M2 of the prior five years. Never before has so much money flowed into the economy in such a short time frame.

Yet, nowhere in the analysis of current inflation does the Fed link the explosion of money to inflation. The most significant mismatch nowadays is between money growth and nominal GDP. However, the Fed still argues that the current inflation uptick is a temporary burst in demand overwhelming supply. (Note: If the Fed believes inflation nowadays is a non-monetary event, what's the purpose of inflation-targeting)?

Another problem with the Fed's discourse on inflation is calling it "transitory." There is no hard and fast rule when something initially thought to be temporary becomes a permanent part of the economic landscape. But a rebound that lasts four times longer and still running is more permanent than transitory.

When the economy was partially closed from March to May 2020, core consumer prices declined in each of the three months, falling less than 0.5% in total. Since then, core consumer price inflation has increased for 11 consecutive months, increasing 3% during that span, the fastest gain in nearly three decades. Why is an 11-month increase of 3% in inflation called "transitory" but a three-month decline of 0.5% not?

Henry Kaufman, the famous Wall Street economist, recently published a book, "The Day the Markets Roared," based on how his 1982 forecast of a decline in market interest rates sparked a global bull market. Wouldn't it be ironic that a prediction from Mr. Kaufman or others that a change in the Fed description or forecast on inflation is coming and that could end the forty-year bull market? Promoting a public perception of inflation that is false creates the potential for bad outcomes.

Comments