February Survey of Manufacturers: Delays in Global Supply Chains & Weak Orders

- Joe Carson

- Mar 2, 2020

- 1 min read

The February survey of US manufacturers from the Institute of Supply Management showed a modest drop in overall activity, with the composite index declining 0.8 percentage points to 50.1. The survey showed that companies are experiencing problems with their global supply chains as the suppliers deliveries index jumped 4.4 points to 57.3---a rise in this index indicates a slower pace of deliveries.

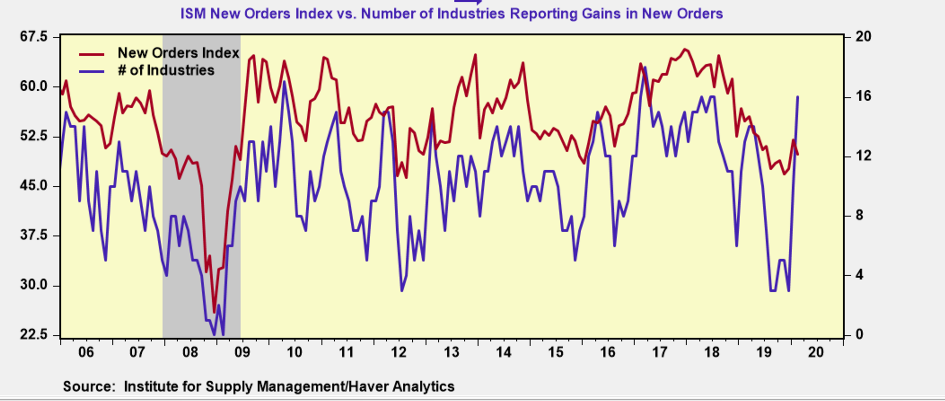

The survey data on new orders was confusing, as it showed an odd combination of weakness and strong breadth.

In February, the new orders index dropped 2.2 percentage points to 49.8, falling below the all-important 50-point threshold for the 7th time in the last 8 month. Yet, the survey also showed that 16 of 18 manufacturing industries reported gains in new orders in February.

Never before has there been such strong breadth and a new order reading sub-50. That combination means the new order increases reported by the 16 industries were tiny, while those reporting declines (transportation and petroleum) were relatively large.

Yet, the key here is the overall direction of new orders and where it stands relative to the composite index. History shows that when the new orders index runs below the composite index more declines in the manufacturing sector occur over the next several months.

Comments