Economy Grew 3.1% in 2023; GDP Rule Bests Inverted Yield Curve Recession Forecast

- Joe Carson

- Jan 25, 2024

- 1 min read

The US economy defied the odds and experts' recession prediction, expanding a relatively strong 3.1% in 2023 and over 4% annualized in the year's second half.

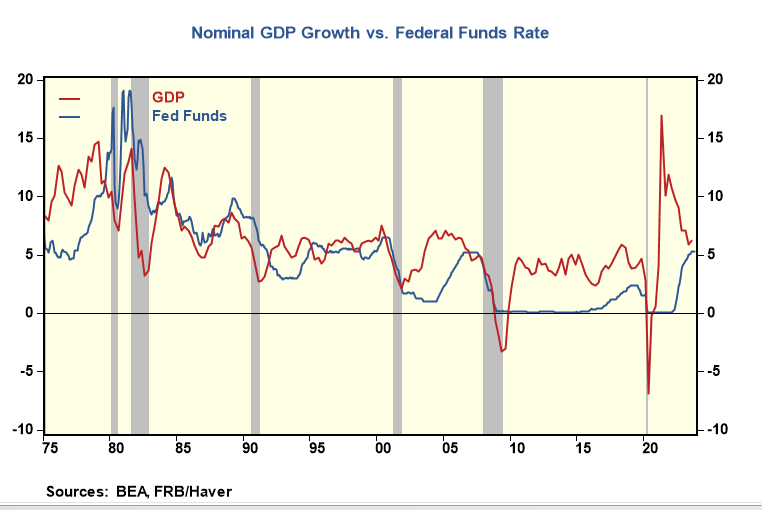

The economy's performance in 2023 was a contest between two indicators over how to gauge monetary policy changes directly impacting the economy. The indicators are the Treasury yield curve, which is spread between short and long-term yields, and the Economy yield curve, which is the spread between Nominal GDP growth and the federal funds rate.

The Treasury yield curve inverted in the fall of 2022. Yield curve inversion is a trusted market signal that monetary policy has become too tight and that a recession will occur in the coming months.

Yet, the economy's yield curve did not confirm that yield curve signal. At no time during 2023 did the fed funds ever exceed the nominal GDP growth. There has never been a recession in the last 50 years when Nominal GDP growth has run above fed funds. At year-end, Nominal GDP growth of 5.8% in 2023 stood 50 basis points over the level of the federal funds rate.

The Nominal GDP rule also works when compared against the 10-year yield. Recessions occurred when 10-year yields were equal to or more times than not when it exceeded the growth in nominal GDP. The spread is roughly 170 basis points, with nominal GDP well above 10-year yields. The Fed's QE program is still depressing market rates, and the risk of recession remains low as long as it exists.

Comments