Deficit Expansion Helped Sustain & Extend the Economic Cycle---How Long Can It Last?

- Joe Carson

- Feb 3, 2020

- 3 min read

Budget deficit expansion has become an end in itself because without it the economic growth cycle would have been less robust, if not stopped in its tracks.

In the past decade government finance, in record scale, has been used to support economic growth. And in doing so government finance crossed an important line.

For the first time in any economic cycle, the scale of the federal deficit (relative to GDP) exceeded the growth in Nominal GDP.

Budget deficit expansion is now being used in ways never envisioned—-lifting the purchasing power and demand of the private and public sectors for the life of the cycle. The key question for analysts and investors is what happens when deficit expansion stops?

Government Finance & The Economy

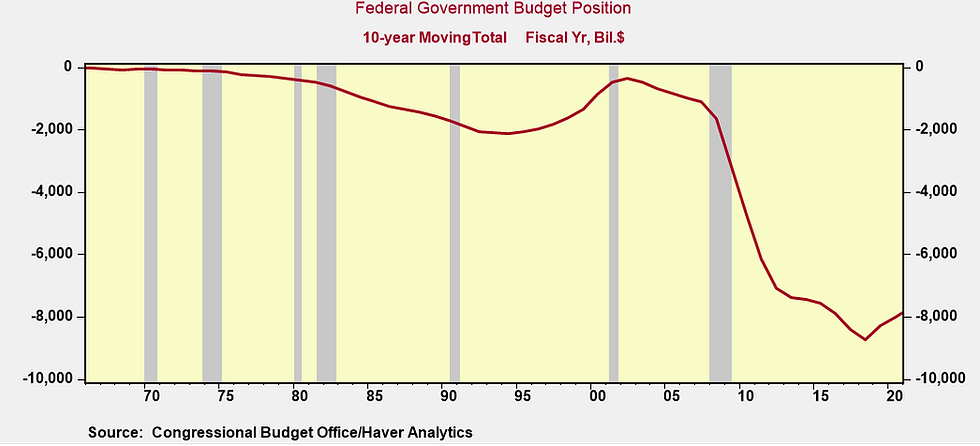

The federal government influences the economy directly and indirectly through its spending and tax policies. Both channels were used in the past decade with Congress passing several large spending bills and business and individual tax cuts to support the economy. In total, over $8 trillion of cumulative deficits were recorded in the past decade.

Measured in relation to nominal GDP the budget deficits averaged 4.9% per year in the past decade, twice the 2.5% annual average recorded during the prior four decades. That’s the equivalent of over $500 billion--based on the current level of Nominal GDP--of additional purchasing power for the private and public sectors.

Critics might argue that average scale of budget deficit in the past decade was inflated by the large deficits that occurred soon after the Great Financial Recession. That’s not the case.

In 2019, the 10th-year of expansion, the federal budget deficit equaled 4.9% of Nominal GDP, matching the decade average.

By way of comparison, the 1990s economic cycle, the only other cycle in the post-war period that also lasted for a decade, ended with the budget surplus of 2.3% of GDP. In other words, the scale of the budget deficit has remained unusually large throughout the 10-year life of the current economic cycle.

Despite the unprecedented amount of support from government finance nominal GDP growth averaged only 4% in the past decade, the lowest of any decade, and other decades experienced one or two recessions whereas the last decade has been recession-free. Even in 2019, the 10th-year of expansion and with unprecedented support from government finance nominal GDP growth was a mere 4.1%.

The argument that budget deficits don’t matter is simply wrong. A budget deficit that exceeds the growth of nominal GDP is much different than one that runs below.

Budget deficits have always been analyzed with the focus on the potential impact on inflation, interest rates and the possible crowding out of private sector borrowers. But now it also needs to be analyzed on the sustainability of the economic cycle as it is being used to increase the purchasing power and demand of the private and public sectors.

A key test on the importance of the deficit expansion and the economy’s growth performance arrives in 2020. Here’s why. Deficit expansion stops,

The budget deficit is estimated to be 4.4% of Nominal GDP growth in 2020, reversing the expansion of the past two years when the budget deficit increased from 3.5% to 4.9% . Both the level and change in the budget deficit is important, but from a growth standpoint, the expansion or contraction in the deficit matters more.

Based on the narrowing in the deficit in 2020 it would not be a surprise if the GDP growth slows relative to 2019’s performance.

Comments