Cyclical and Structural Forces in Labor Markets Makes The Fed's 2% Target Obsolete

- Joe Carson

- Mar 16, 2022

- 2 min read

Never before has the US economy faced a labor shortage so early in a business upturn. Labor shortages are evident across many occupations and industries, impacting large and small firms. Changing demographics, domestically and globally, indicates that labor market shortages have structural features, along with cyclical ones. Higher labor costs hamper the Fed inflation fight as firms raise prices where they can to cover rising wages. That creates a dilemma for policymakers; publically accept a higher targeted inflation rate or purposely maintain the old target of 2% but never hit it.

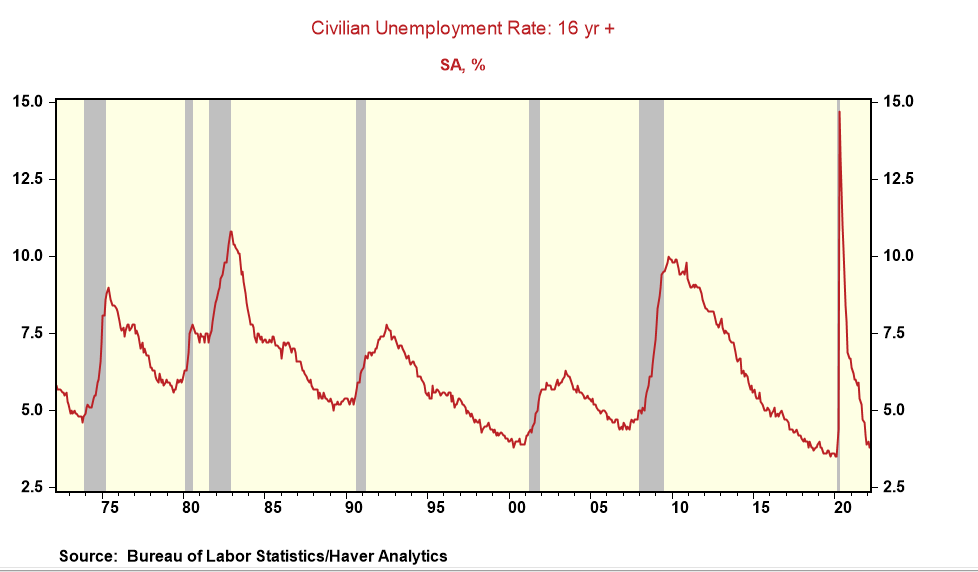

2022 marks the second year of an economic growth cycle. The civilian unemployment rate at 3.8% in February is roughly half the average of the jobless rate at the same point in prior cycles. To be sure, in the past five economic recoveries, which covers 1975 to 2020, the average unemployment for the second year of economic recovery was 7.4%.

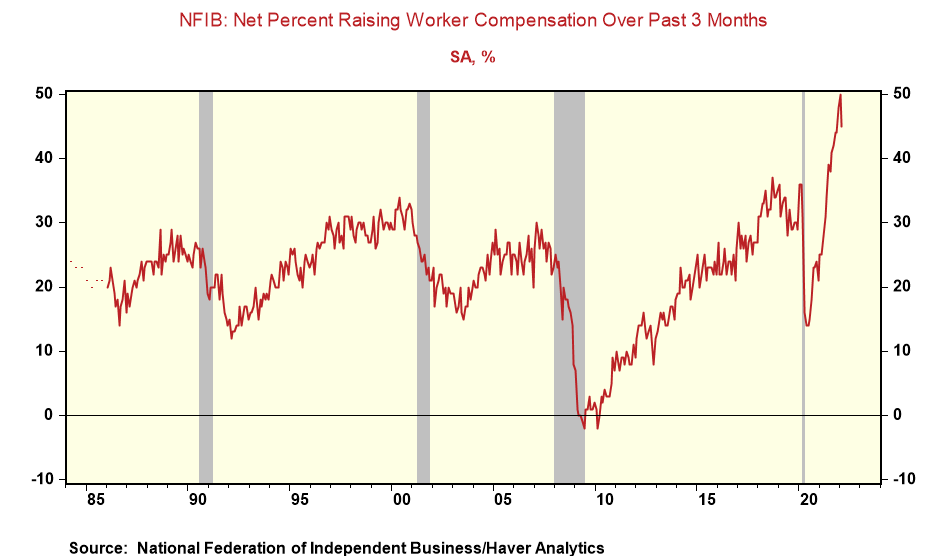

The National Federation of Independent Business, an association of small business owners, has tracked firms' compensation plans for over 40 years. The typical cyclical pattern of compensation plans is to drop in the early years of an economic upturn and rise later (see chart.) Not this time; a record percentage of firms (roughly 50%) have raised compensation, and a relatively high percentage (over 30%) plan more in coming months.

Yet, there are structural forces at work as well. For example, Charles Goodhart, a former central banker in the UK, points out that a glut of cheap labor globally helped policymakers achieve a sustained low inflation rate. But, in his opinion, that era is over. It will be followed by a period of labor shortages, thus keeping upward pressure on wages for the foreseeable future.

Sustained low inflation rates of the past decades do not guarantee future success. Policymakers must acknowledge that the current economic cycle is fundamentally different from the past and that the luck factor (excess labor) is no longer. Persistent wage pressures could easily add 100 basis points, or more, to the trend rate of inflation over the next several years.

It took policymakers more than a year before realizing that the inflation surge was not transitory. How long will it take them to admit that past cycles' 2% price target is no longer obtainable with the cyclical and structural changes in the labor markets? My bet is the current generation of policymakers will never forecast a longer-term inflation rate above the 2% target. At the FOMC meeting in December, policymakers' long-term inflation projections remained at 2%, a month after the Fed Chair "retired" the transitory description of inflation.

Will policymakers raise their longer-term inflation projections at today's FOMC meeting? Investors should not expect a sea-change in policymakers' inflation expectations. Mr. Powell and other policymakers still believe they have the "tools" to bring inflation back to the 2% mark. Yet, in reality, the cyclical and structural changes in the labor markets will result in a reported inflation rate that runs consistently above the 2% target. Consequently, investors should prepare for a higher trend rate of inflation and discount the promises and projections of the Fed.

Comments