Contrarian 2024 Forecast: Record Household Liquidity Points To Solid Growth & More Fed

- Joe Carson

- Nov 15, 2023

- 2 min read

Households are operating with record amounts of liquidity. What is so unusual and, at the same time, remarkable about the recent surge in household liquidity is that it occurred during one of the sharpest Fed tightening cycles. Fed tightening cycles are supposed to drain liquidity eventually, but not this time, at least not yet. Households have more liquidity than before the tightening cycle started in 2020, and it's rising again. With record household liquidity, why are so many predicting a recession in 2024?

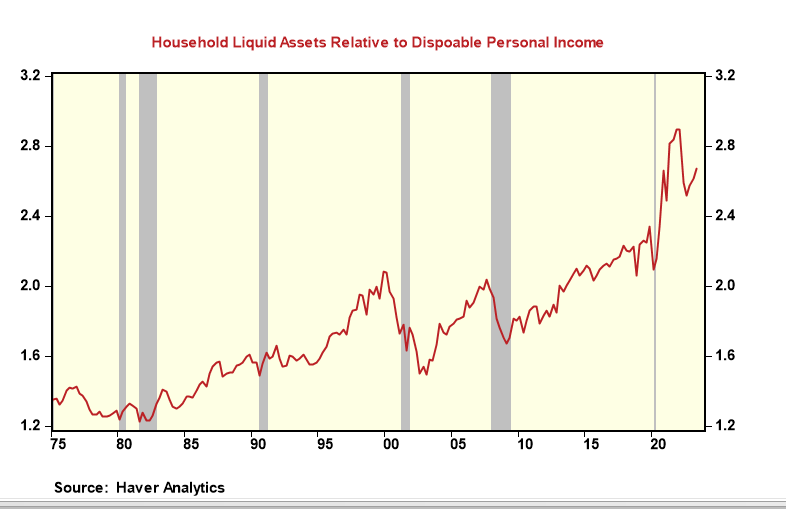

At mid-year 2023, households' direct holdings of deposits, debt securities, and equities stood at 2.7X times disposable income. That stands far above the 2.0X times peak registered during the economic cycles of the 1990s and the early 2000s and amounts to $15 trillion of additional liquidity relative to the previous two robust liquidity cycles. Even with an uneven distribution skewed towards the upper-income groups, the scale of household liquidity is so big that it bodes well for continued strength in consumer spending.

Why hasn't the current household liquidity cycle followed the sharp reversal patterns of the late 1990s and mid-2000s, even though the current tightening cycle is more significant in scale than the prior two?

A couple of thoughts:

The tightening cycle started at zero interest rates.

It took policymakers eighteen months to get the level of official rates equal to and above core inflation. And real rates are still low from a historical perspective.

The impact of the Fed's tightening cycle was weakened/lessened by record quantitative easing (direct purchases of securities) and still is.

Whatever the reason or reasons are, the history of liquidity cycles is quite clear; increases in liquidity are associated with positive growth, and decreases in liquidity are associated with negative growth (See chart).

The current pattern of household liquidity flows is the opposite (i.e., higher and rising) from what preceded the 2001 and 2007/08 recessions. That alone directly challenges the recession and bearish forecasts for 2024.

Liquidity is the lifeblood of spending and economic cycles. As long as liquidity remains ample, spending and growth cycles don't end. Based on the pattern of liquidity flows, the contrarian 2024 forecast is solid growth and unchanged or a higher Fed funds target rate.

Comments