Consumer Services Inflation Cycle Matters The Most: Fed Tightening Cycle Far From Over

- Joe Carson

- Jan 12, 2023

- 1 min read

Last month, consumer prices for goods fell 0.3%, driven by a sharp fall in energy commodity prices, down 4%. Consumer prices for services rose 0.4%. Since consumer services account for 70% of the overall price index (and 58% excluding energy services), that's the price cycle the Fed needs to crack before it can be confident that overall inflation is slowing to its 2% target.

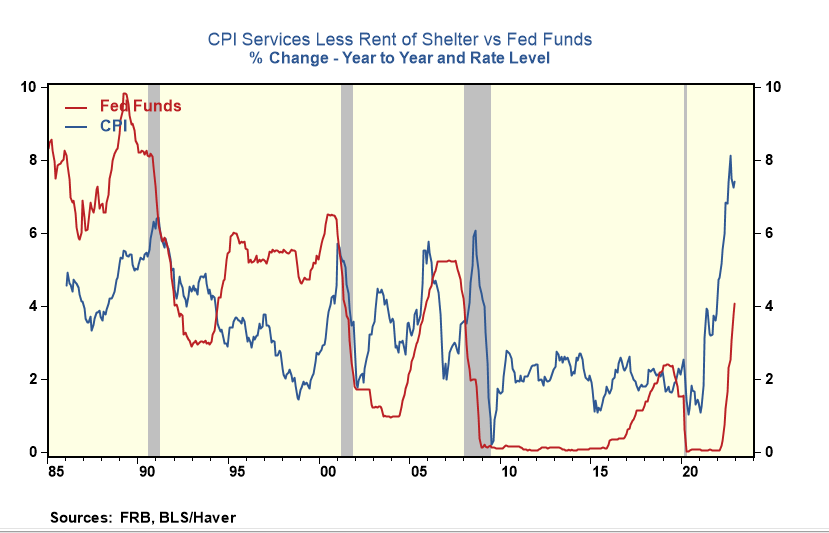

Breaking consumer services price cycles take time and significant increases in official rates. Since the mid-1980s, consumer services inflation cycles have reversed after the federal funds rate exceeded the inflation rate, sometimes by substantial amounts. At the end of 2022, the Fed was far from reaching the level of official rates that broke prior inflation cycles.

That's because consumer services, excluding energy services and core consumer services less shelter, posted year-on-year increases of 7% and 7.4%, respectively, in December. So the current fed fund rate range of 4.25% to 4.5% is still 300 basis points below consumer services inflation.

The financial markets are betting that the Fed has little more to do to reverse the inflation cycle, while history says there is much more to do. Who's right? I bet the historical pattern between inflation and the fed policy repeats itself; investors, beware.

Comments