Bank Credit Crunch----Will It Happen or Not? And If It Happens, Will It Be "Transitory"?

- Joe Carson

- Mar 26, 2023

- 2 min read

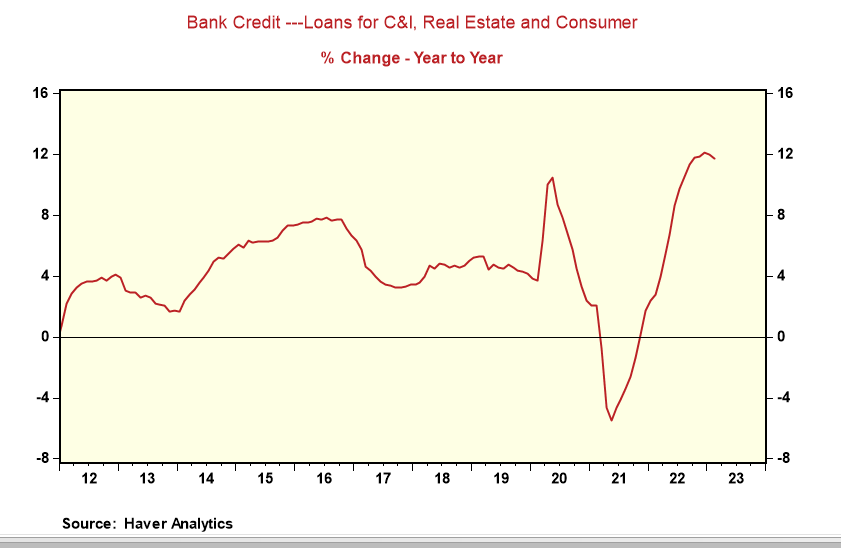

For the week ending March 15, bank lending to commercial, industrial, real estate, and consumers increased by $40 billion, following a slight increase of $10 billion in the prior week. The two-week increase was more than half the cumulative increase over the previous two months, January and February.

It is far too early to assess the impact of additional changes in lending standards. But the early March lending data reflects the tighter lending standards and the rise in market rates over the past year. And even with those tighter lending and higher rate conditions, the banking system showed a willingness to lend and businesses and consumers an appetite for borrowing.

A bank-driven credit crunch may eventually happen, and investors are betting something substantial will occur, given the sharp drop in yields. But a few things may mitigate its impact, if not limit, its duration.

First, all the top commercial banks are well-capitalized and do not face any liquidity constraints. It is hard to see a broad, deep, and enduring credit crunch that does not involve the top banks.

Second, the Fed's Bank Lending Program should ease mid-tier banks' liquidity issues, and that should limit any pullback in credit due to tighter standards. The program runs for an entire year.

Third, market interest rates have dropped significantly, which could boost the demand for credit.

It is instinctive for investors to rush to buy the safest and most liquid assets, even when there is a hint of a banking crisis. That's the playbook investors have used in prior financial crises. Still, a 125 basis points drop in two-year yields over a few weeks is far bigger than during the early months of the 2007-09 financial crisis. The economic and financial data must support that negative narrative on yields for them to stay.

History has shown that the "price" of credit has been the main rationing factor for credit. And until the "price" of credit gets more expensive through market forces or Fed raising rates, any pullback in credit should prove to be "transitory."

Comments