August CPI Report: Inflation Cycles Are Non-Linear; Rotate; Service Inflation Cycles Hard To Break

- Joe Carson

- Sep 13, 2023

- 1 min read

Updated: Sep 14, 2023

The August report on consumer prices shows that inflation cycles are not linear; inflation patterns rotate, and service sector inflation cycles are hard to break.

In August, headline consumer prices rose 0.6%. That represented the most significant month-over-month increase since June 2022. Also, that broke a 13-month pattern of successively lower headline annual inflation readings, proving that inflation cycles are not linear, up or down.

Second, commodity (or goods) prices rose 1% last month, which accounted for much of the acceleration in the headline. That was only the fourth time in the previous fourteen months that consumer commodity prices increased, illustrating that inflation patterns tend to rotate over time, with some items growing almost every month and others occasionally.

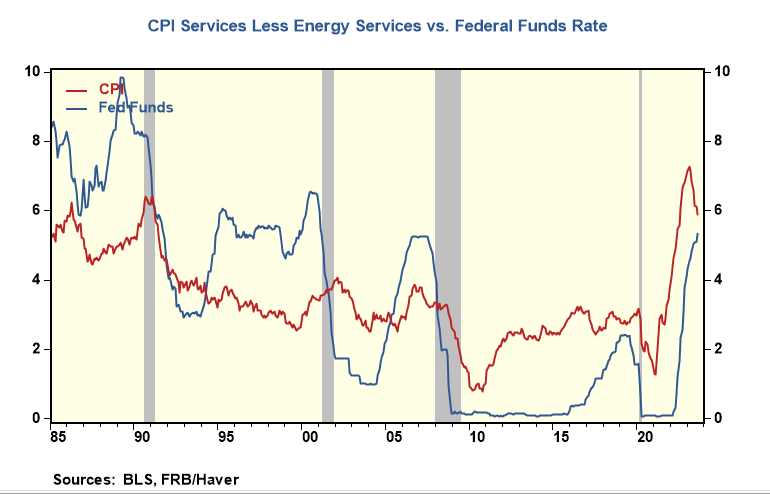

Third, in August, consumer service prices rose 0.4% and 5.9% in the past twelve months. Since the mid-1980s, consumer services inflation cycles have reversed after the federal funds rate exceeded the inflation rate, sometimes substantially. Consumer service inflation is still above the current fed fund rate range of 5.25% to 5.5%. Several analysts argue that the Fed tightening cycle is over. The history "bookie" says the odds of another rate hike are higher than what analysts think.

Comments