At What Point Does "QE" Cross the Line?

- Joe Carson

- Jul 14, 2023

- 1 min read

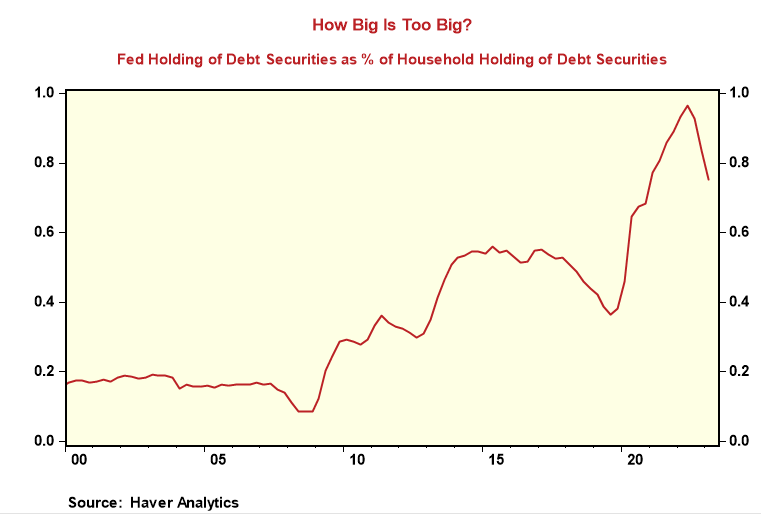

At what point does the Fed's buying of debt securities cross the line and become so big that it manipulates the financial markets? In 2022, the Fed's debt securities holdings roughly equaled what households own directly and indirectly in other managed accounts. Before the financial crisis, the Fed's holdings were below 20%, moved to 50% after the crisis, and the pandemic pushed it to a record high near 100%. Perhaps so many trusted financial indicators have erred in recent months because finance is no longer a free market--- QE is manipulating it.

Comments